Here’s one of the opening salvos, brought to you by the Affordable Care Act of 2010: the IRS has now issued guidance regarding changes to Flex-Spending plans (or Flex Spending Arrangements, FSAs), which has changed things for folks who use these plans – specifically the medical expense reimbursements.

Here’s one of the opening salvos, brought to you by the Affordable Care Act of 2010: the IRS has now issued guidance regarding changes to Flex-Spending plans (or Flex Spending Arrangements, FSAs), which has changed things for folks who use these plans – specifically the medical expense reimbursements.

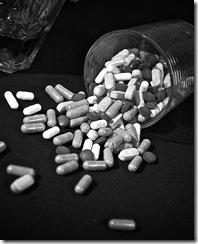

In the past, these plans have been eligible to reimburse the owner of the account for a myriad of medical expenses, not only physician expenses, prescription drugs, and other health care expenditures, but also over-the-counter medicines or drugs (not controlled by prescription).

Beginning in 2011, due to the Affordable Care Act, over-the-counter drugs and medicines that are not ordered by prescription will no longer be eligible for reimbursement from a medical Flex-Spending plan. The change does not affect insulin, even if purchased without a prescription, or other health care expenses such as medical devices, eye glasses and contact lenses, co-pays and deductibles.

This new standard goes into effect for purchases made January 1, 2011 or after, and a similar standard is due to be in place for Health Savings Accounts (HSAs) and Archer Medical Savings Accounts (Archer MSAs). But never fear, reimbursements are still going to be available for your 2010 expenditures through March 2011 as always.

If you have one of these FSAs, you’ve probably gotten into a situation in the past (I know I have) where you had too much money set aside through the year for your “regular” medical expenses, and so at the end of the year you make up the difference by stocking up on standard over-the-counter drugs and medicines. This option will no longer be available to you at year-end in 2011.

Stay tuned as more of this quite helpful guidance comes along. I’m sure we’ll be collectively satisfied with the results – or but then again, probably not.

Photo by gregorfischer.photography

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.