The recent passing of the SECURE Act brought about some changes that have impacted savers and retirees alike. Required minimum distributions (RMDs) from retirement account have now been raised to age 72. Also, gone is the ability to “stretch” required distributions from retirement accounts to non-spouse beneficiaries (with few exceptions).

The recent passing of the SECURE Act brought about some changes that have impacted savers and retirees alike. Required minimum distributions (RMDs) from retirement account have now been raised to age 72. Also, gone is the ability to “stretch” required distributions from retirement accounts to non-spouse beneficiaries (with few exceptions).

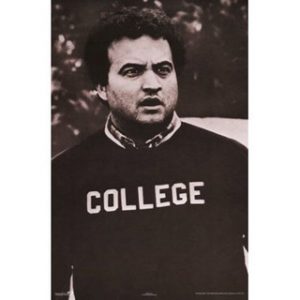

One potentially beneficial change comes from the broadening of the expenses 529 college savings plans can cover. 529 plans are tax-advantaged savings plans that allow parent, grandparents, and other relatives to save money for education. Contributions grow tax-deferred and withdrawals for qualified expenses are tax-free. In the past, qualified expenses included, tuition, books, fees, etc.

With the passing of the SECURE Act, another provision has been added that allows account owners to pay for student loan principal and interest. This new rule allows up to $10,000 maximum to be used to pay for outstanding student loans. In addition, the SECURE Act also allows an additional $10,000 to pay for the student loans of any sibling of the plan beneficiary. In other words, each sibling of the beneficiary is allowed up to $10,000 to pay down student debt – from the same 529 plan.

This new rule can help parents with left over money in the 529 plan pay down the debt of beneficiaries and their siblings. It should be noted, however, that any student loan interest paid from the 529 plan is no longer eligible for the student loan interested deduction at tax time (sorry – no double dipping).

The impact of this new rule may see more money flow into 529 plans as it removes some of the uncertainty of what to do with leftover funds once a beneficiary graduates. One word of caution: grandparents who own 529 plans may want to wait to distribute funds for the beneficiary until after the student graduates (assuming the graduate has outstanding loans).

The reason being is that a distribution for a non-parent owned 529 plan negatively impacts any financial aid the beneficiary may be eligible to receive. A distribution while the beneficiary is in college counts against the student’s financial aid as income to the student – likely reducing their eligibility for a higher financial aid award. After graduation, however, this dilemma no longer exists.

The Tax Cut and Jobs Act passed a few years ago allows 529 owners to pay for expenses related to elementary and secondary education. This new rule is only at the federal level. As of this writing, some states (such as IL) do not consider elementary and secondary school expenses as qualified expenses. In other words, federally, the expenses are qualified, but in some states they are not. This means that some states (IL) will tax and penalize this type of distribution.

The explanation above is mentioned because as of this writing, it has yet to be determined whether states (such as IL) will treat the payment of student debt from a 529 plan as a qualified expense. It’s allowed federally, but remains to be confirmed among state plans.

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC®

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

loved your blog, looking forward for more updates by you