As a father of two kids myself (and supposedly a financial planner), the book offered many insights to me as a father and as a planner. After all, even I have questions about how to get my kids to think about the way money works and the family finances.

Mr. Lieber’s book does an excellent job of how to answer the money questions kids ask. Naturally, kids see the world through different lenses and it’s in their nature to ask question. Such questions about money Mr. Lieber covers range from the “Are we rich?” to handling what kids see their friends have that they do not.

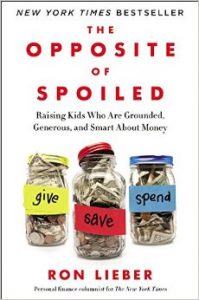

Taken right from the cover is Mr. Lieber’s take on how to teach kids to allocate their money. On the cover can be seen three clear jars. One is labeled Give, another Save, and the last, Spend. The book teaches how to allocate these amounts and to which jars. The wisdom from this idea alone is arguably one many adults can use as well.

Although geared mainly toward parents it’s also a book that I would recommend to grandparents. One of the main reasons why is to help grandparents understand the lessons their children are trying to teach the grandkids. This especially hits home when Mr. Lieber talks about how grandparents can overindulge their grandkids on birthdays and holidays which may contradict and impede the lessons parents are trying to convey. Granted, this can be a touchy issue. But it’s one the book may help parents and grandparents who deal with this matter on special occasions.

The Opposite of Spoiled is a fun, enjoyable book that will be read again as my kids continue to grow. The book’s guidance for parents is a wonderful asset to help us with teaching and encouraging our kids to think and talk about finances openly; rather than ignoring their curiosity or worse, raising kids who are afraid of money.