Last week my article 3 Myths About Social Security Filing Age included some information about year-to-year break even points for the various Social Security filing ages. This prompted some questions about the break even points between all filing ages, not just the following year.

Last week my article 3 Myths About Social Security Filing Age included some information about year-to-year break even points for the various Social Security filing ages. This prompted some questions about the break even points between all filing ages, not just the following year.

So for example, what are the break even points between choosing to file at age 62 versus age 66 or age 70?

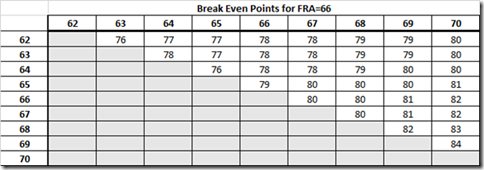

This article shows the approximate break even points between all of the various filing ages. The first chart shows the break even points when your Full Retirement Age is 66. To use the chart, select your first filing age decision on the left, then move right to the second filing age you’re considering:

So, for the decision between filing at age 62 versus age 66, you can see that the break even point is at the age of 78. Comparing filing at age 66 with age 70, the break even point is at age 82.

It should be noted that these break even points are the age you will be when cumulative benefits received at the later filing age becomes greater than the cumulative benefits received based on the earlier filing age. The specific break even points occur sometime during the year indicated, as the analysis is done on an annual basis (not month-to-month). In other words, the actual break even month might be any month during that year. With this difference in mind, the prior article has been updated to reflect the same. Previously the analysis showed the first full year that the later filing age was superior to the earlier filing age.

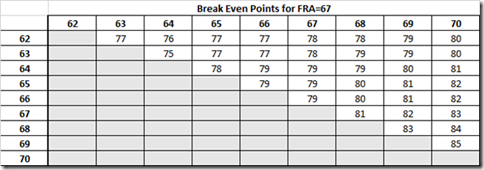

This second chart shows the break even points for when your FRA is 67. It is used exactly the same as the chart above.

As before, choose the first filing age in the left column, and then move to the right for the break even points for the various filing ages. If you were choosing between age 63 and 66, for example, the break even point is age 77. Between age 65 and age 70, the break even point is 82.

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

In the FRA=67 chart, is I was considering SS benefits at 62, compared to 63 or 64 why would the break even for 63 be 77 and break even for 64 be 76?

I’ll have to review this, as I agree it doesn’t look right. The difference may be because of the change in reduction between age 62 and 64 due to the longer time span under FRA – but that’s just a guess. I’ll check on it and get back with you.

As I suspected, this anomaly is due to the difference in the amount of benefit available as a 64-year-old compared to a 63-year-old (when comparing both to a 62-year-old). The break-even is slightly lower against the 64-year-old versus the 63-year-old filing age.

Hello Jim,

If I have filed and suspended as of this year and was trying to wait until age 70 to collect the largest amount per month of SS. What does the break even point mean to me? Might it be better to collect at age 68 perhaps? My wife will request a restricted filing next year at FRA.

Thanks,

Jeff

The choice between filing years is your call of course. The break even point between choosing to file at age 66 versus age 70 is 82 – meaning if you or your wife lives 12 years beyond your age 70, the delay paid off. If you filed at 68 instead of 66, the break even point is two years sooner. So if you think you’re not going to live to 82 (and you wife won’t either) then you should file earlier.

A little late in giving you thanks, Jim, so thank you for all the help you have given me and others throughout the year. Your expertise is very valuable. I must say when you had your article about File and Suspend and deadlines my wife and I took advantage of that and are up and running before the time ran out. That was a huge help to us as she now is receiving half of my social security benefit and letting hers grow.

You’re most welcome, Jeff. It’s gratifying to know that the work I’m doing has helped folks in a real way.