The below article is an excerpt from my new book Social Security for the Suddenly Single. This focused book is all about divorcee Social Security retirement and survivor benefits, and it’s available on Amazon. The book was written to address the lack of information about divorcee Social Security. You’ll find everything you need to know about divorcee Social Security retirement and survivor benefits within.

The below article is an excerpt from my new book Social Security for the Suddenly Single. This focused book is all about divorcee Social Security retirement and survivor benefits, and it’s available on Amazon. The book was written to address the lack of information about divorcee Social Security. You’ll find everything you need to know about divorcee Social Security retirement and survivor benefits within.

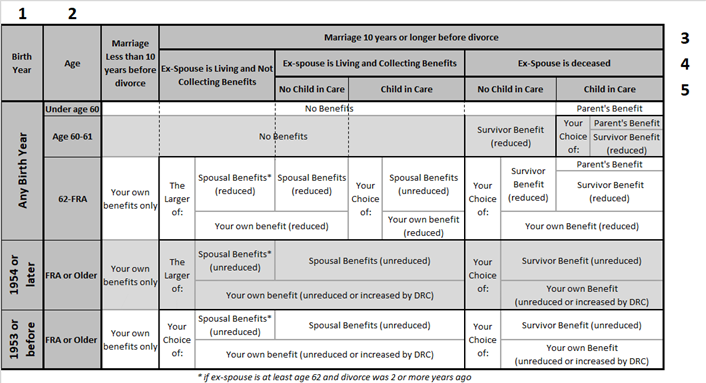

Divorcee Benefits Matrix

Below you will find a matrix that describes the various divorcee Social Security benefits you may have available to you.

To use this matrix, start at 1, choosing your birth year. Then move to 2 and choose the age you wish to learn about available benefits. Now choose your length of marriage (3), and your ex-spouse’s status (living or deceased) – 4. Lastly, choose the appropriate column for 5, whether or not you have a Child in Care under age 16.

Case: Bernadette

As an example, Bernadette was married to Robby for 17 years. Robby is still living, age 62, 2 years older than Bernadette. Robby has not begun collecting benefits at this point. The couple has no children, and they have been divorced for one year.

Bernadette is wondering about the earliest benefits she can receive from Social Security. She starts in column 1 with “Any Birth Year”, and then reviews the second column. At her present age of 60, she sees that while Robby is still living she is not eligible for any benefits.

So she looks to the next row in the Age column (2) – indicating age 62 to FRA. Since her Step 3 value is that the Marriage lasted 10 years or longer, Bernadette next checks step 4 – Robby is still living, and not presently collecting benefits. However, by the time Bernadette reaches age 62, it will have been two years since the divorce. Because of this, Bernadette sees that she is (between the ages of 62 and her FRA) eligible for the larger of the reduced Spousal Benefit or her own reduced benefit.

Bernadette would also like to estimate what her benefit would be if she waits until her FRA or later to apply for benefits. Knowing what she knows from the previous exercise, she would just move down the table to the appropriate Step 1 value. Her birth year is 1957 so she chooses the row “1954 or later”. This indicates that Bernadette will be eligible for the larger of her own benefit or the Spousal benefit – neither benefit is reduced since this estimate is assuming she’s either at or older than FRA.

Lastly, Bernadette would like to check on what benefits she might be eligible for upon Robby’s death. Moving to the right on the matrix to the set of columns indicating the ex-spouse is deceased, and since there is no Child in Care, Bernadette can review the various Survivor Benefit options that are available at various ages for her. At her present age (60) she would be eligible for a reduced Survivor Benefit if Robby were to die. At any age from 62 to FRA, she would be eligible for her choice of the reduced Survivor Benefit or her own reduced benefit. At or older than FRA, she has the same choice available, but neither benefit is reduced once she’s reached FRA or older.

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

I am divorced, married less than 10 years. I have my own ss benefits built up. My question is will my future income affect the dollar amount I am currently scheduled to receive. For example, if I earn less now would it lower my annual salary average and therefore lower my future benefit amount? Thank you.

It depends on what your earnings have been over your lifetime, by comparison to the earnings you may (or may not) receive in the future toward your benefit. SSA has some calculators that can help you with the process of modeling potential future earnings and how that might impact your potential Social Security benefit. You may need to sign up for an account at SSA.gov in order to access some of the more complicated calculators.