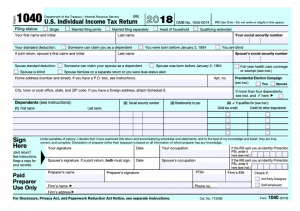

The long-awaited 2018 Form 1040 has been finalized by the IRS. It comes very close to the promised “postcard” size, at 8½ x 5½, two-sided.

Here’s the front page:

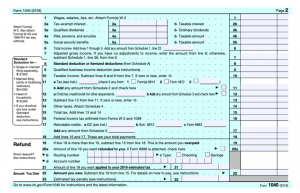

And here’s the back page:

You can go to the IRS.gov website to see Form 1040 “live”.

Turns out that, apparently, all that was necessary to make the Form 1040 “easier” was to just create new schedules and move lots of pieces from the old Form 1040 to new schedules.

Gone from Form 1040 are many components that we’ve grown to expect: IRA deduction, for one, was always on the front page of Form 1040, one of the traditional “above the line” deductions in calculating the Adjusted Gross Income.

The IRA deduction is still available, but you have to file a separate Schedule 1 (brand new for 2018) to take it and many other above the line deductions. I suppose now we’ll start referring to these deductions as Line 7 deductions – because that’s where they landed on the new form.

There are several of these new Schedules to get used to. As mentioned, Schedule 1 is where you’d include additions to or subtractions from your gross income to arrive at the adjusted gross income. Some examples of additions include: business income (from Schedule C), capital gains and losses (Schedule D), farm income (Schedule F), unemployment compensation, prize or award money, and gambling winnings. Subtraction examples include: student loan interest deduction, self-employment tax, educator expenses, and IRA contributions. Effectively all of Schedule 1 comes from the old Form 1040 front page. The figures from Schedule 1 are applied to Form 1040 in Line 6 (additions) and Line 7 (subtractions).

Schedule 2 encompasses Alternative Minimum Tax (AMT) and excess advance premium credit repayments. The total of these amounts flows to Line 11b on the new Form 1040. This Schedule replaces the old Lines 45 & 46.

Schedule 3 is for non-refundable credits (other than the child tax credit and the credit for other dependents). Located here are the foreign tax credit, child and dependent care credit, education credit, Saver’s credit, and others. The Schedule 3 total flows to Line 12 on Form 1040, and is added to the child tax credit and credit for other dependents (Line 12a). Schedule 3 has replaced Lines 50-54, and new Line 12a replaces old Line 49.

Schedule 4 is for additional taxes, such as self-employment tax, extra tax on retirement plans (Form 5329 tax), and other additions to tax. The result from Schedule 4 flows to Line 14 on Form 1040. This Schedule has replaced Lines 57-62.

Schedule 5 is where the refundable credits come in. These were previously located on lines 66-73. Earned Income Credit has its own place on Form 1040, on Line 17a, as do the additional child tax credit (Line 17b) and the American Opportunity credit (Line 17c). The rest of the refundable credits are found on Schedule 5: estimated tax payments, net premium tax credit, and the like. These amounts from Schedule 5 are included with the above three items produce a sum on Line 17 of Form 1040.

Schedule 6 has limited applicability – it is for taxpayers with a foreign address or who wish to designate a third party to discuss their tax return.

All in all, I’d say we didn’t improve much with this change. The instructions are actually a bit longer than before, at 117 pages (versus 107 for 2017 Form 1040). But that’s likely due to the introduction of the new schedules and the like.

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.