While the statement is designed to be pretty well self-explanatory, I thought it might be beneficial to review the statement so that you know what the statement is telling you. The statement has been redesigned recently, so it will look considerably different from the old school statement.

First Page

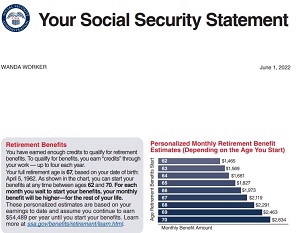

The first page of the statement contains a host of really important information for your benefit. Under “Retirement Benefits” you’ll find your Full Retirement Age (based on your date of birth), and to the right of this paragraph you’ll find a chart with the estimated monthly benefit that you are eligible for, with the assumption that you continue to earn at the same rate as your most recently-reported earnings.

Below “Retirement Benefits” you’ll find information about your “Disability Benefits”, including the amount that you could receive if you became disabled right now.

Next on the page is the estimate of “Survivor Benefits” that could be available to your spouse and/or dependents upon your demise.

To the right (below the Retirement Benefit chart) is the information about your eligibility for Medicare benefits. This includes your age for eligibility and your current status – whether you’ve earned enough credits for Medicare eligibility.

Second Page

The Second Page of the statement lists out the details of your Earnings Record in the left column. This section is important to review carefully… you should review the earnings listed for each year against your tax records or W2 statements, to make sure that the information the SSA has is correct. In addition to reviewing for correctness, you should look over your record and note the “zero” earnings years, as well as years that you earned considerably less than what you earned (or are earning) in later years.

There are details on how to report any inaccuracies that you might find on your statement. It’s much easier to resolve things earlier in the process rather than later – when you’re possibly under the gun about applying for your benefits.

It should be noted that in the interest of saving space, your earliest earnings records are combined by decade. You can review each individual year’s earnings record online in your my Social Security account.

As we’ve discussed in the past, your benefits are based upon your 35 highest earning years. If you have had some “zero” years in the past or some very low earnings years, you can expect for your estimated benefit to reflect any increases that the current year’s income represents over your earlier low earnings or zero years. This only becomes significant once you have a full 35 year record in the system.

Another key here is that your projected benefits listed on the first page are based upon your earnings remaining the same until your projected retirement age(s). If you choose, for example, to retire at age 55 and have no earnings subject to Social Security withholding, your projected benefit could be reduced since those years projected at your current earning level will actually be “zero” years. Alternatively, your earnings might not be zero but much lower than projected if you have a lower salaried job during that period. This reduction is in addition to any actuarial reductions that you would experience if you choose to take retirement benefits before FRA.

There are tools and calculators available on my Social Security to help you with projecting your potential benefit with more accuracy. In addition, there are many tools available, some free and some paid, all around the internet.

If you have gaps showing in your earnings history, you may have had a job that was not covered by Social Security, so you will be interested in knowing how the Windfall Elimination Provision (WEP) affects you, and how the Government Pension Offset (GPO) may affect your family or benefits that you may be eligible for from your spouse. This is briefly covered in the right column, and if it is apparent that you might be impacted by WEP or GPO, there may be an additional fact sheet attached to your statement.

The bottom of the left column shows how much tax you and your employer have paid into the system over the years – both the Social Security system and Medicare system. This can be an eye-opener… quite often we don’t realize how the money we’ve paid in can stack up!

Third Page (there’s a third one?)

The Third Page of the statement lists Important Things to Know about Your Social Security Benefits. Hopefully you already know these facts, but just in case you don’t, it makes good sense to review them periodically. (For some folks, this list is provided on the second page of the statement and the overall statement is only two pages in length. I think most standard statements are three pages long these days, along with addenda listed below.)

Addenda

Included with your statement could be several addenda, depending on your circumstances. Among the possible addenda for your statement could be:

- Retirement Ready Fact Sheet (everyone should get one of these, adjusted messages depending on your age)

- Social Security Basics for New Workers (when you’re just starting out)

- How You Become Eligible For Benefits (you’ll receive this until you have the required 40 quarters of coverage)

- Additional Work Can Increase Your Future Benefits (you may receive this if you’ve begun recording zero years)

- You Have Earnings Not Covered By Social Security (You will receive this if your earnings record indicates some of your earnings was not covered. This doesn’t mean WEP or GPO is part of your future, just that they might impact your future benefits.)

- Medicare Ready (when you’re approaching age 65)

- Supplemental Security Income And Other Benefits (you may receive this addendum if it appears by the facts that you might be eligible for SSI or other programs)