We’ve covered a lot of ground with regard to how various tax laws impact your retirement plans: pensions, IRAs, 403(b) and 401(k) plans. But we’ve primarily focused on the US income tax laws (the IRS) affect your plans – and there are many nuances that you need to take into account with regard to state tax laws.

We’ve covered a lot of ground with regard to how various tax laws impact your retirement plans: pensions, IRAs, 403(b) and 401(k) plans. But we’ve primarily focused on the US income tax laws (the IRS) affect your plans – and there are many nuances that you need to take into account with regard to state tax laws.

State Tax

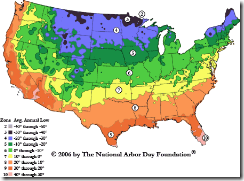

The big deal with state tax laws and retirement plans is that some states have special tax deals for money inside of retirement plans. If you happen to live in (or are planning to move to) such a state, it makes good sense to understand any special nuances in the tax laws before doing anything.

This is due to the fact that, for example, it could make a huge difference in the tax impact if you cashed out a plan in one state versus another. Here in Illinois, there is no state tax on retirement income – whether from a pension plan, from an IRA or from a 401(k), as well as Social Security benefits. The same is true for Iowa, Mississippi and Pennsylvania. So if you are planning to move to Illinois (for example) for retirement – it would pay off if you wait until you move to your new home before withdrawing IRA assets, especially if you’re moving from somewhere with a high state income tax.

In addition to those states, there are 9 states that have no income tax at all – therefore those states also do not tax retirement income. These nine states are Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

Some states with an income tax will provide certain exemptions for retirement income. For example, twenty-six states exempt military retirement pay from income tax (Alabama, Arizona, Arkansas, Connecticut, Hawaii, Illinois, Indiana, Iowa, Kansas, Louisiana, Maine, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Nebraska, New Jersey, New York, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Utah, and Wisconsin). Nine more states only partially tax military retirement pay (Colorado, Delaware, Idaho, Kentucky, Maryland, New Mexico, Oregon, South Carolina, and West Virginia, plus the District of Columbia).

Social Security benefits are untaxed by most states. Only Colorado, Connecticut, Kansas and Minnesota tax this income, and most of these have some formula for at least a partial exemption.

So pay attention to, and get acquainted with, the tax laws in your state and any states you’re considering for a new home (either in retirement or at another time in your life) so that you don’t miss out on any tax treatment – or worse, make a move that precludes some tax treatment from being available. You might want to plan your distributions until you get to the new state, for example, if retirement income is untaxed there.

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.