Generally speaking, your tax preparer should have old records for you – as long as it wasn’t too long ago. Sometimes this is a challenge for the preparer, as changes to software and office systems can result in difficult to retrieve records, although within reason your preparer should be able to get the forms for you.

If your preparer either doesn’t have the information or you’re reluctant to approach the preparer for the information, or you’ve moved, or the preparer is no longer in business, you have another option available to you: the IRS.

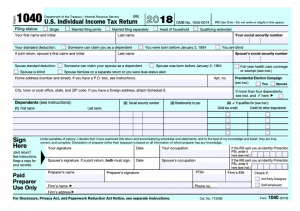

According to this IRS Tax Tip, there are things you need to know if you need federal tax return information from a previously-filed tax return.

Taxpayers who didn’t save a copy of their prior year’s tax return, but now need it, have a few options to get the information. Individuals should generally keep copies of their tax returns and any documents for at least three years after they file.

If a taxpayer doesn’t have this information here’s how they can get it:

Ask the software provider or tax preparer

Individuals should first check with their software provider or tax preparer for a copy of their tax return.

Get a tax transcript

If a taxpayer can’t get a copy of a prior year return, then they may order a tax transcript from the IRS. These are free and available for the most current tax year after the IRS has processed the return. To protect taxpayers’ identities, this document partially hides personally identifiable information such as names, addresses and Social Security numbers. All financial entries, including the filer’s adjusted gross income, are fully visible. People can get them for the past three years, and they need to allow time for delivery.

Here are the three ways to get transcripts:

- Online. People can use Get Transcript Online to view, print or download a copy of all transcript types. They must verify their identity using the Secure Access process. Taxpayers who are unable to register or prefer not to use Get Transcript Online may use Get Transcript by Mail to order a tax return or account transcript type. Taxpayers should allow five to 10 calendar days for delivery.

- By phone. Taxpayers can call 800-908-9946 to request a transcript by phone. Transcripts requested by phone will be mailed to the taxpayer.

- By mail. Taxpayers can complete and send either Form 4506-T or Form 4506-T-EZ to the IRS to get one by mail. They use Form 4506-T to request other tax records: tax account transcript, record of account, wage and income and verification of non-filing. These forms are available on the Forms, Instructions and Publications page on IRS.gov.

Request a copy of a tax return from the IRS

Prior year tax returns are available from the IRS for a fee. Taxpayers can request a copy of a tax return by completing and mailing Form 4506 to the IRS address listed on the form. There’s a $43 fee for each copy and these are available for the current tax year and up to seven years prior.