|

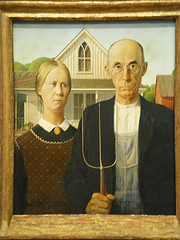

Recently, I had the opportunity to sit across from a couple nearing retirement, and looking for some options with regards to their cash flow needs, possible retirement dates, and the ever-present question, “Do we have enough?” Typically, these conversations involve careful consideration given to a number of different worries, fears and “big” problems that clients face. Frequently I will work with couples who have a hard time agreeing on how much they can spend in retirement, how much the can afford to save, and where to prioritize and allocate the money (to retirement, a wedding, college, etc.).

This couple, however, was different.

Well in position to enter retirement comfortable with little, if any to worry about, the tension between these two spouses could be cut with a knife – it was almost tough to sit through. One would snip at the other, and the other would interrupt while the snipping was happening to snip back. Small jabs, really – and nothing to get too excited about – at least in this practitioner’s opinion. Were they arguing about needing more, where to save, who will work more? Not at all. They were arguing about the little things. One spouse was upset because the other spouse was spending money on a local community newspaper subscription, while the other was upset about spending on something similar.

After about 20 minutes of quasi-hostile bantering back and forth, they asked my opinion. And here’s what I told them:

Autonomy.

I suggested that they each allocate a certain portion of their earnings each month to separate and personal checking accounts. I also suggested that other than knowing the amounts going in each month to each account, they needn’t discuss the purchases they make from their respective, separate accounts – it was their money to do with what they wanted, from newspaper subscriptions to purchasing items for a hobby. The looks on their faces were of genuine consideration of the idea. And they seemed to relax just a bit in their chairs. This couple was brilliant on the big things, but was letting the little things hamper their progress toward their financial planning goals. They left the office saying they would give it a try.

For couples I have recommended this to, the results have been extremely favorable. Many couples often report a sense of freedom, even though they may not feel chained down to their mutual budgets. Some have even reported using the money to buy gifts for the other spouse, relating back to the time when they were dating and such gifts were surprises, not expected and known purchases from the mutual account.

Financial autonomy can be a great tool in financial planning for couples. And sometimes being allowed to have some independent control on the little things, makes working together on the big things tolerable, if not enjoyable.

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.