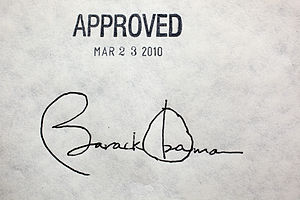

President Barack Obama’s signature on the health insurance reform bill at the White House, March 23, 2010. The President signed the bill with 22 different pens. (Photo credit: Wikipedia)

Several high-profile companies have recently made known that they will be directing retirees and in some cases employees to the Health Exchanges with the implementation of the Affordable Care Act (aka “Obamacare”). How this will wind up affecting us as taxpayers is uncertain, to say the least (See the article at this link: Workers Nudged to Health Exchanges Seen Costing U.S. Taxpayers).

Since participation in the Exchanges carries the possibility of taxpayer subsidy to those with lower incomes, adding more folks to the rolls of the Exchanges will likely drive up the cost of these subsidies. And of course, that will mean increased taxes to pay for the subsidies.

It makes sense for IBM, Time Warner and others to send the retirees to the Exchanges with a stipend, since the stipend will be less (presumably) than the cost to the company for health coverage in the long run. Many of the retirees will (likely) fit into the subsidized categories since they are in retirement and likely have lower incomes, so a portion of the cost will certainly be subsidized.

What do you think – is this a trend? And what if the Exchanges become the dominant method of health insurance delivery? Would the law of large numbers eventually begin to bring down the overall costs, or will the costs spiral out of control?