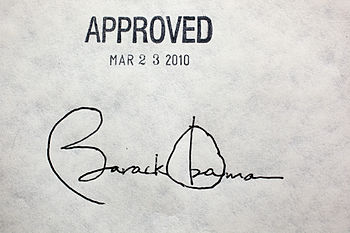

English: President Barack Obama’s signature on the health insurance reform bill at the White House, March 23, 2010. The President signed the bill with 22 different pens. (Photo credit: Wikipedia)

Note: this provision has been repealed beginning with tax year 2019.

As you may already be aware, individuals are required to carry health insurance on themselves and their dependents, as of January 1, 2014. This is the mandate set forth in the Affordable Care Act – and of course it’s an important part of making the whole Act work. Small businesses (less than 50 employees) have a similar mandate to provide coverage for employees beginning in 2015, or face penalties themselves.

Without mandating insurance coverage for everyone, the system can’t sustain the lower-cost options for folks who desperately need the medical coverage. This includes folks who are not covered by any other means (employer, Medicare, Medicaid or individually-purchased policies) and who have medical problems that require costly care. With the mandate, healthier individuals will also have to pony up and purchase health insurance, so that the overall cost is spread among both healthy and not-as-healthy individuals.

There are a few ways that the penalty can be avoided:

- Having an insurance policy purchased via the Affordable Care Act Healthcare Exchange for your state.

- Having an insurance policy from any other source that meets the minimum standards of the “bronze” level plan on the exchanges. This includes employer-provided healthcare or other group policies (such as via an association), as well as individually-purchased policies.

- If the coverage costs more than 8% of your household Adjusted Gross Income – this applies to employer-provided insurance as well as the net cost of a bronze-level policy from the exchange. If your income is so low that the cost of either type of policy is more than 8% of your AGI, you will not be penalized.

- If you have to go without coverage for a period of less than 3 months, such as when changing jobs, you will also not be penalized.

- The same goes for folks who can prove that a hardship has caused them to go without coverage, such as if your policy was canceled and you otherwise cannot afford a policy. (This one is a bit odd, it seems that the situation is covered via #3 above, but I guess that wasn’t complicated enough!)

If you don’t fit any of the above exceptions, you may owe this penalty. The penalty is the greater of either $95 per person in the household (half that if the dependent is under 18), capped at $285; or 1% of Adjusted Gross Income over the minimum to file a tax return ($20,300 for couples or $10,150 for singles, plus $3,950 per dependent). At no time can the penalty be more than the cost of the basic bronze-level policy offered on the exchanges.

When your income is less than certain limits, you will receive a tax credit for a portion of the cost of the insurance coverage. These limits are prescribed by the Act, and the upper limit is 4 times the federal poverty limit – for a family of four, this amounts to $94,200; for a single person, the limit is $45,960. The credit varies between the limit for filing (mentioned above) and the 400% poverty limit line. This credit can be paid directly to the insurance provider, lowering your monthly premium (if you’ve purchased via the exchanges) or you can wait to receive the refundable credit when you file your income tax return.

A Quirk

There’s a quirk about this law concerning the penalties for not having insurance: The penalty, which is actually called a tax, is administered by the IRS, collected with your income tax return each year. However, unlike income taxes and other taxes collected with your income tax return, the IRS cannot use a lien against your property or a levy against your income in order to collect the penalty if owed. In addition, any amounts unpaid are not charged interest (as with other taxes). The only way that the IRS can force payment of the penalty is by withholding refunds from other taxes reported on the tax return. If you’re astute, you’ll notice that there is a planning opportunity there – although not recommended nor for the faint of heart.