Photo credit: jb

The question comes up pretty often: when contributing to an IRA, should you choose the Roth or Traditional? I often approach this question in general with my recommended “Order of Contributions”:

- Contribute enough to your employer-provided retirement plan to get the company matching funds. So if your employer matches, for example, 50% of your first 5% of contributions to the plan, you should at least contribute 5% of your income to the plan in order to receive the matching funds.

- Maximize your contribution to a Roth IRA. For 2015 that is $5,500, or $6,500 if you are age 50 or older.

- Continue increasing your contribution to your employer-provided plan up to the annual maximum. So if you have more capacity to save after you’ve put 5% into your employer plan to get the matching dollars, and you’ve also contributed $5,500 (or $6,500) to your Roth IRA, you should increase the amount going into your employer plan. Increase this amount up to the annual limit if possible. For 2015 the annual limit for employee contributions to an employer plan like a 401(k) is $18,000 (plus a catch-up amount of $6,000 if you’re age 50 or older).

Beyond those three items if you have more capacity to save, you may want to consider college savings accounts or tax-efficient mutual funds in a taxable account among other choices.

But the question I was referring to is this: Which is better – a Roth or Traditional IRA?

The answer, as you might expect, is a fully-qualified “It depends”. The are several important factors to take into consideration.

If you were to compare the two types of accounts side-by-side, at first glance you’d think that it doesn’t make any difference which one you contribute to – especially if you assume that the tax rate will be the same in retirement (or distribution phase) as it was before retirement (or accumulation phase). This is because you’d be paying the same tax on the distribution of the Traditional IRA after the investment period, simply delayed, that you would pay on the Roth contribution, only this part is paid up-front.

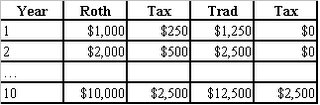

Clear as mud, right? Let’s look at the following table to illustrate. I have purposely not included any increases in value, as we’ll get to that a bit later. In the example, we’re using a 20% ordinary income tax rate.

Each year we had $1,250 available to contribute to either a Traditional or a Roth. We had to pay tax on the Roth contribution each year, but we were able to make the whole contribution of $1,250, tax-deducted on our Traditional account.

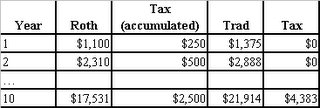

What happens when we factor in growth in the account? The following table reflects the next step in our analysis, with each account growing at 10% per year, and the values are as of the end of the year:

If you subtract the tax from the Traditional balance, you come up with the same number as the Roth account, since there is no tax on the Roth account at distribution. So, although you pay more in taxes, you had more contributions to your account, so it all comes out in the wash.

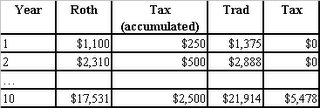

So far, I’ve not come up with a convincing argument for a Roth or Traditional IRA. Let’s make another change to our table, by assuming that the tax rate in distribution increased to 25%, and that we remain at a 20% rate during accumulation. The following results come from that change:

As you can see, this results in a nearly $1,100 increase in taxes at distribution, making the Roth IRA the preferred option. Conversely, if the ordinary income tax rate is lower in distribution, the Traditional IRA is a better option.

There are some other factors that we could consider and run calculations on, but for the most part we’ve covered the important bases. Depending upon your own situation, one might be better than the other, and the reverse could be true in slightly different circumstances.

However, strictly going by the numbers the Roth IRA is preferred when the income tax rate is higher in retirement, and it’s at least as good as the Traditional IRA if the rates remain the same. If the numbers were the only differences between the two accounts, this is not a strong argument for the Roth, because you’re just making a gamble as to what will happen with tax rates in the future.

Thankfully, there are more factors to bear on the decision. In my book An IRA Owner’s Manual I point out three very good reasons to choose the Roth IRA over the Traditional IRA (excerpt below). With those factors in mind, and given that most folks have a generally pessimistic view of tax rate futures in the US, it seems that the Roth IRA is the better choice in nearly all situations.

Three Very Good Reasons to Choose

The Roth IRA Over the Trad IRA

- Roth IRA proceeds (when you are eligible to withdraw them, at or after age 59½) are tax free. That’s right, there is no tax on the contributions you put into the account and no tax on the earnings of the account. You paid tax on the contributions when you earned them, so in actuality there is no additional tax on these monies.

- There is no Required Minimum Distribution (RMD) rule for the Roth IRA during your lifetime. With the Trad IRA, at age 72 you must begin withdrawing funds from the account, whether you need them or not. For some folks, this could be the biggest benefit of all with the Roth IRA.

- Funds contributed to your Roth IRA may be withdrawn at any time, for any reason, with no tax or penalty. Note that this only applies to annual contributions, not converted funds, and not the earnings on the funds. But the point is, you have access to your contributions as a sort of “emergency fund of last resort”. While this benefit could work against your long-term goals, it may come in handy at some point in the future.

- (a bonus!) A Roth IRA provides a method to maximize the money you pass along to your heirs: Since there’s never a tax on withdrawals, even by your heirs, the amount of money you have in your Roth IRA is passed on in full to your beneficiaries, without income taxation to reduce the amount they will eventually receive – estate tax could still apply though.

As illustrated, if you believe ordinary income tax rates will remain the same or increase in the future, the calculations work in favor of the Roth IRA.

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

Agreed on all points.

The tables, as laid out, forget about the “Global” Compounding function of interest. (Global defined as total wealth of a client on his balance sheet) The total tax liability in simple addition forgets that there is a net differential that is calculated with interest on the first day. As all financial advisors know, after last year more than ever…if you go 50% down last year and then 50% up the following year you are still not whole. (Remember this point when I point out about making up a 15% deficit in my next argument)

I am not sure I can explain what I mean without complete boredom ensuing.

Let’s just say, outside the benefits and qualification, an investor has a choice between a Roth or Traditional IRA. The money to invest comes from a real net worth and income of the participant. If you invest their qualified money and their taxable investments in concert…then every Roth subscriber ultimately has less taxable money to invest after they pay, instead of deferring. Alternately the investor that goes with the Traditional IRA has the same qualified money, though he saves the deferred taxes in his taxable account as an immediate savings to invest, today.

Savings (Before) IRA Total Wealth (After)

Roth Investor $14000 $4k $13,000

(25% Tax)

Trad. Investor $14000 (Before) $4k $15, 000

(25%)

The Roth Investor loses some taxable savings and net worth today for additional benefits and the maybe he will avoid a bigger bill later…if he makes it to retirement. (I defend against “IF’s” for my clients, not use them for financial conjecture or hypothesis)

The Traditional Investor gets a refund of $1000 to his savings account. that was a tax bill for the Roth Investor. Imagine the compounding effect of an investor adding an additional 15%+ to his portfolio every year especially in their early years.

i.e. I would hate to be the Advisor that has to compete with another, over time, that will always be 15% ahead on January 1st. 15% is a heck of a return differential to catch up to, in just one year. Couple a 15% head start with a 10% market return, in year 1, and the gap widens. This gap, quite possibly, will be more than enough to cover any current and future taxes that may (another word for “IF) occur.

Let me know if you follow this thought. Thanks for subscriber access to your blog it has great information.

You make some compelling arguments, Damon. As I indicated previously, I don’t disagree with your points.

It is assumed that the tax deduction is always invested, which often in reality is not the case. This doesn’t negate the point, it’s just another factor to consider.

At any rate, this discourse has pointed out that the question isn’t necessarily cut and dried – each individual’s circumstances needs to be considered in weighing out the possibilities.

Thanks for the input, Damon – glad to have you involved!

jb

Loved the blog. This is the most popular question we get in our practice.

With that being said,

I have yet to experience with any of my clients, an increased tax liability upon retirement. Even my higher net worth clients, in general have less taxable income (in retirement) and automatically are in a lower tax bracket the day they retire.

I have no doubts that taxes will go up over time, especially after the last couple of years with government spending. My concern is that most folks do not have more income in retirement, they have less. (On average a 15% lower bracket on less income even taking into account their RMD’s)

In other words, if my clients had more income in retirement than in their working years….Roth is much better. If they have less and by one or two conventional brackets… I am not sure this theory is correct. (Unless we go to a 55% flat tax in 2030.)

Discuss?

-Damon

First of all – I apologize for the missing tables from the post… that’s what happens when you move things around from three-plus years ago. I’ve replaced the tables, so the post should make a little more sense now.

On to Damon’s comments: I don’t disagree with what you say about income being lower for a retiree as opposed to a “near retiree” – but the post was geared toward folks at all age levels. With that in mind, it’s not hard to believe that 20, 30, 40 years in the future taxes will be higher for most everyone, versus the aggregate tax deduction over the years.

When you take the other flexibility benefits into account – access to the contributions at any time for any reason and no RMD requirement – coupled with the tax-free growth, the Roth is pretty darned attractive, in my humble opinion.

As Damon indicates, Roth IRA contributions may not be as beneficial later in your working career – but typically at this stage you’re covered by a retirement plan and your income is high enough that you can’t make deductible contributions to a traditional IRA anyhow.

jb