You’ve undoubtedly heard of the marriage penalty for income taxes – this is where it can be beneficial tax-wise for two people to remain single than to be married and be forced to file either jointly or separately. The tax code contains several ways that this is true. But did you know that there is a way that married folks might level the field versus singles in the Social Security law-scape? Plus, divorced folks may also have an advantage over singles AND married folks who were never divorced (or who divorced after marriage of less than ten years)?

The Marriage Advantage

When a worker remains single over his or her working life, there is an inequality in benefits paid out based on his or her record when you compare it to that of a married person. Here’s what happens:

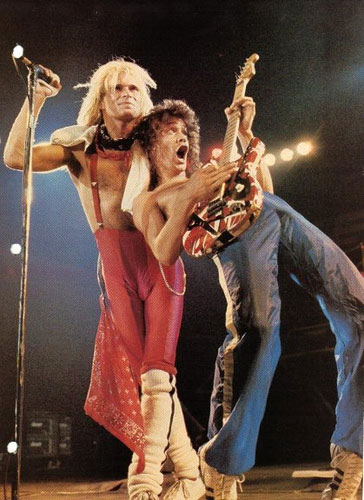

Let’s say Dave and Eddie are the same age, with the same earnings record over their lifetimes (in fact they worked side-by-side for most of their careers). Dave has been single his whole life, but Eddie married Valerie 30 years ago and they remain married. Both Dave and Eddie are 66 this year, and they both file for their Social Security benefits, at a rate of $2,000 per month.

At the same time, Valerie didn’t work very much outside the home (not enough to be eligible for Social Security benefits on her own record – she only worked one day at a time). However, since she’s also 66 this year, she can file for a spousal benefit based on Eddie’s Social Security record, in the amount of 50% of Eddie’s age 66 benefit, or $1,000.

So, for the exact same amount paid into the Social Security system over the years, Eddie’s earnings have generated benefits 50% greater than Dave’s.

And it doesn’t stop there – if Dave and Eddie both live to age 80, but then Valerie lives another five years after Eddie’s death, she will receive a survivor benefit equal to Eddie’s benefit for those additional five years. There is no survivor benefit paid on Dave’s record since he was never married.

The Un-Divorced Penalty

When a worker is married for more than 10 years, gets divorced and then remarries, each spouse that he is either currently married to or was married to for more than ten years is eligible for spousal benefits based upon the worker’s record. In this way, the Social Security record of someone who has been married more than once (if the marriage(s) lasted at least 10 years before divorce) will bear even more fruit than the record of Eddie above and definitely more than Dave. For example:

Tom was married to Jane for 22 years and then they divorced. Not long after, he married Dana and remains married to her to this day. Jane never remarried, and she never worked outside the home – and neither did Dana. All three, Tom, Jane and Dana are 66 this year. Tom decides to file for his own Social Security retirement benefits at $2,000 per month, and Dana files for the spousal benefit based on Tom’s record, for $1,000 per month. Jane also decides to file for Spousal Benefits based on Tom’s record as well (Jane didn’t remarry after her divorce from Tom), and her benefit is $1,000 per month as well (50% of Tom’s age 66 benefit).

So, with the exact same earnings record as Dave and Eddie (from our first example), benefits paid on Tom’s record amount to $4,000 per month – double the benefits paid on Dave’s record, and 33% more than the benefits paid on Eddie’s record.