As the spring semester comes to end for high school and college graduates, I wanted to perhaps give some unsolicited advice as these newly christened adults start out on their own and begin making life choices and financial decisions that will impact their future.

As the spring semester comes to end for high school and college graduates, I wanted to perhaps give some unsolicited advice as these newly christened adults start out on their own and begin making life choices and financial decisions that will impact their future.

- Resist the temptation to spend everything you make. Instead, do your best to save as much as you can. In fact, it’s possible for a recent college grad to go from making hardly anything during their college years to a decent starting salary. Pay yourself first. Establish an emergency fund of 3 to 6 months of living expenses and save to your 401k and IRA. It’s absolutely possible to save $23,500 annually ($18,000 to the 401k and $5,500 to the IRA). In ten years, without interest or compounding, you’ll have saved close to a quarter-million dollars. All by the time you’re between the ages of 28 and 31. It’s simply a matter of what you prioritize.

- You don’t need a new car. Throwing money away with a car payment or worse, a lease payment isn’t necessary. Save up and buy a nice used car with cash, or simply keep driving the vehicle you have. Depending on where you live, you may not need a car at all. Public transportation, riding a bike, or carpooling are other ways to forgo making a payment on a depreciating asset.

- Live below your means. Simply put, this means living on less than you make. Scrutinize every expense. Ask yourself if it’s necessary to live, or if it’s just a want. Do you need to go out for dinner or would you be better off grocery shopping and making a cheaper meal at home? Is cable TV necessary or will an inexpensive HDTV antenna fit the bill? Do you that smartphone or phone plan? Spending less than you make and living below your means puts you at a huge financial advantage both now and later in life.

- Avoid debt. Debt can get you into trouble – and fast. Should you acquire and use a credit card, pay it off immediately. Having consumer debt is just another way of saying you couldn’t afford it in the first place. The only debt that you should realistically have is your home – and even then, don’t buy more than you can afford. Consumer debt compounds and works against you. Before buying anything with a credit card, ask yourself if you really need it, and if you can pay it off immediately. If the answer is no to either question, don’t buy it.

- Ignore the Joneses. You may have heard of the phrase “keeping up with the Joneses”. Whatever the last name of your friends, colleagues, or acquaintances, try your best not to keep up with their lifestyle. Often you will see these people with new cars, new houses, and all sorts of new “stuff”. On the outside, all of this “stuff” may give the impression of success. In reality it’s often masking what they are keeping up with – debt payments. The Joneses have the appearance of success, wealth, and freedom when in fact they are slaves to their debt and living paycheck to paycheck. Find friends that share your view on finances and frugality. You’ll enjoy their company more and find it less stressful to associate with them.

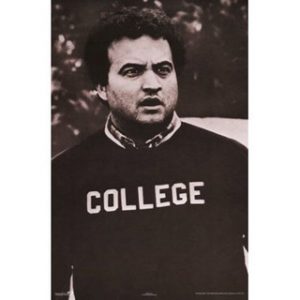

- Invest wisely. When you save to your 401k and IRA, choose low-cost, well-diversified index funds. You can’t control markets and you can’t control the economy. You can control your expenses. Low-cost index funds or ETFs provide excellent diversification among asset classes while keeping your expenses low. Once your portfolios are set up, leave them alone! Check them once a year at most. Time is on your side. Your human capital is huge (why you went to college) but your financial assets are scarce (why you can afford to save so much). Save as much as you can and let time do the rest.

- Focus on experiences, not stuff. Much of what you buy loses its luster after a short period of time (a new car, for example). Focus on enriching yourself with experiences. Take time to read that book you’ve always wanted to read. Learn that new hobby or leisure activity you’ve been interested in. Explore new places that don’t cost a lot to experience.

- Be grateful. Make it a habit to be grateful for what you have, where you are, and what you’ve been given. The more appreciative you are of what you have, the more likely you’ll be happy with your life and what you have. The simple please and thank you your parents taught you is just as important when you’re an adult.

- Give back. Chances are, you didn’t get to where you are on your own. A parent, friend, colleague, or someone you don’t even know was beneficial to your success. Give back. Pay it forward. This could be through service work, volunteering, or making charitable donations to a local charity or someone in need. Donate “stuff” you no longer need or use. It will benefit someone else. And when you give, give without expectation of receiving something back and try to give in secret.

Good luck!

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

Nice list. I would suggest even taking a step back and emphasizing that when taking first real job really understand the benefits package. Understand the 401(k), its match if any, and the Fund offerings. Once invested be sure to get online to understand the 401(k) website. Usually there is a lot of valuable info on the site. Starting out, young people are typically in a sweet spot to save – they don’t have 3 kids on the verge of going to college, aging parents to look after or the need to seriously innovate the house to accommodate a larger family. Take advantage of the sweet spot to build the “nest egg” early on!

Finally, make a habit of reading this blog!

Really liked these – great post for the graduates as they begin adulting!