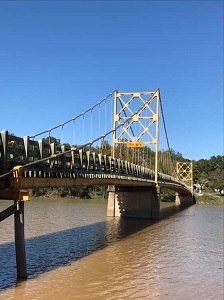

Photo credit: coop

Three of the most common ways that you can withdraw funds from your IRA without penalty are: 1) reaching age 59½; 2) death; and 3) disability. Below is a brief review of each of these conditions for penalty-free withdrawal:

- Reaching Age 59½ When you reach age 59½, you can withdraw any amount from your IRA without penalty, for any reason. The only thing you have to remember is that you must pay ordinary income tax on the amount that you withdraw. This means that, once you have reached the date that is 6 months past your 59th birthday, you are free to make withdrawals from your IRA without penalty. You are not required to take distributions at this age (that happens at age 70½).

- Death Upon your death at any age, the beneficiaries of your account or your estate if you have not named a beneficiary, can take distributions from your IRA in any amount for any reason without penalty. In fact, your IRA beneficiaries in most cases must begin withdrawing from the IRA, taking required minimum distributions annually, or taking the entire account balance out within 5 years after the death of the original owner. See the article RMD from an Inherited IRA for more details.These distributions are taxable as ordinary income to the beneficiary, but no penalty is applied.

- Disability If you are deemed “totally and permanently disabled” you are also eligible to withdraw IRA assets for any purpose without penalty. Total and permanent disability means that you have been examined by a physician and the disability is such that you cannot work, and the condition is expected to last for at least one year or result in your death.