Photo credit: jb

Don’t let the alphabet soup in the title put you off. If you’ve never come face-to-face with a QDRO you might not need to know this – but then again, the basic underlying premises are good information to understand…

First some definitions, just so we know what we’re talking about:

QDRO: Qualified Domestic Relations Order – this is a method for permitting distributions from a qualified retirement plan (not an IRA) in the event of a divorce. How a QDRO works is that, upon the decreed division of assets, if a retirement plan (such as a 401(k) or 403(b)) of one spouse is chosen as an asset to be divided and a portion given to the other spouse, a QDRO is issued. The QDRO allows the division to occur without penalty… otherwise, making a distribution from a qualified plan before age 59½ would result in penalty and possible taxation, as we all know. The QDRO provides a way (allowed by the IRS) for the receiving spouse to rollover the funds into an IRA of his or her own, without tax or penalty to either spouse.

NUA: Net Unrealized Appreciation – this is a special provision from qualified retirement plans that allows the employee to elect to treat company stock differently from all other assets in the plan when making a distribution from the plan. Essentially, you pay ordinary income tax on the basis, original cost, of the stock in your employer’s (actually former employer’s) company, and then place the stock in a taxable brokerage account. At this point, any gains on the stock are subject only to capital gains tax (rather than ordinary income tax, which is a much higher rate). The trick is that you can only do this maneuver one time, and the distribution must be in a lump sum of all your 401(k) account holdings. Everything in the account that is not company stock can be rolled over into an IRA and maintain tax deferral as usual. It’s critical to note that this can be the only distribution of funds from the account. If you were to distribute any amount, even a small amount from the employer plan in a previous year, you are no longer eligible to use the NUA provision on this employer account.

QDRO and NUA

So the question comes up – if a QDRO distribution occurs for your account, and that distribution includes company stock: does this “bust” the original employee’s ability to later have the company stock treated with the NUA privilege, since the rule states that the distribution must be a one-time single lump-sum distribution?

(drum roll…) The answer is NO. A QDRO is a division of the account, and though technically a distribution has occurred, this distribution does not impact the remaining account’s ability to take advantage of the NUA provision. The employee can go ahead and, upon separation from service, perform the lump-sum distribution of the stock and rollover the remainder into an IRA and get the NUA treatment for the stock.

Now, if you’re really astute, the last paragraph made you think of another question (it’s okay to admit it if you aren’t tax-geeky enough to have thought of this question): Can the ex-spouse (the one receiving a split of the employee’s plan) elect NUA treatment of any stock that was included in his portion of the account?

(drum roll…) The answer is a qualified YES. The qualification is this: As long as the rest of the account is eligible to be distributed (to include NUA treatment), the QDRO’d portion of the account can also take advantage of this provision.

In other words, although the ex-spouse of the employee could rollover the QDRO’d qualified retirement plan into an IRA at any time, if the account contains appreciated employer stock (stock of the former spouse’s employer) – it may be in the best interest of the receiving spouse to wait until the employee reaches age 59½ or leaves employment (termination or retirement), so that she can take advantage of the NUA provision. Otherwise, any rollover will squash this option forever.

Example

Here’s a quick example to illustrate: Dick and Jane are divorcing. Dick has a 401(k) plan with his employer, including some stock in his employer. Part of the divorce includes a QDRO to give Jane half of the 401(k) plan.

Once the QDRO is completed, Dick still has his original 401(k) account (albeit diminished by half), and Jane has an account in the plan of equal size. Jane can rollover those funds into an IRA at any time, if she chooses, without penalty. However, since the account holds highly appreciated company stock, in order to qualify for NUA treatment, she must maintain the account in the 401(k) plan until Dick terminates employment, retires, or reaches age 59½. At that time, she can pull the lump-sum distribution for NUA treatment and rollover the rest into an IRA. Dick can elect NUA treatment for his account when he terminates employment or retires.

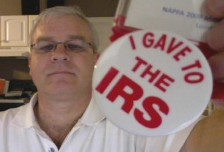

Now you may be wondering about that picture… the button is the prize that a person gets when in a seminar with Natalie Choate, the renowned IRA expert – if you happen to ask a question that she is unable to answer. I asked the above questions of Mrs. Choate recently and received the button. No disrespect for her whatsoever – as an admirer of her work, I am proud of the button and wanted to share it here.

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.