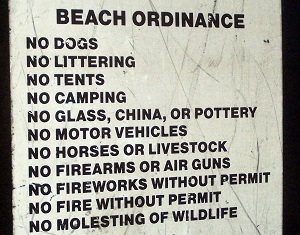

Photo credit: diedoe

I’ve written in the past about the types of transactions that are prohibited in your IRA, and how these transactions are generally quite onerous if you happen to use one of them. In fact what happens is that your entire IRA becomes disqualified as of the first of the year in which the transaction occurred.

So – if you’re inquisitive you might wonder: How could I use this to my advantage?

It is possible to work this rule in your favor – but I don’t necessarily recommend it. I present this option here as an exercise of what could be done according to the rules. I learned this one from Natalie Choate, by the way, who you may recall I regard as a rock star in the world of IRA law.

Working in your favor

So, given that the rule against prohibited transactions requires that the IRA is considered to have been entirely distributed on the first day of the tax year when the prohibited transaction occurred, this is a factor that could be used to work to your advantage.

Let’s say for example you owned an investment in your IRA that was worth $10,000 as of the first of the year. Over the course of the year, the investment has now grown in value to something ridiculous, let’s say $500,000. If you were particularly inventive, you might take advantage of the rules and perform some sort of prohibited transaction with your IRA before the end of the tax year. By doing so, your IRA would be disqualified as of the first of the year, and the investment you owned would have been considered distributed at that point in time.

This means that you would owe ordinary income tax on the original $10,000 value, and your investment then has a basis of $10,000 – if you sold it now at its $500,000 value, the additional $490,000 would be taxed at the capital gains rate. If your ordinary income tax rate is 25%, the tax on the full $500,000 would work out to $125,000. But under this plan, only $10,000 is taxed at 25% ($2,500), and $490,000 is taxed at 15% ($73,500), for a total tax on the IRA of $76,000, a savings of $49,000. You’d have to wait until at least the second day of the following year in order to qualify for long-term capital gains. (The above tax calculation is oversimplified. In the real world, the rate of tax would be considerably higher since you’d be bumped up several tax brackets, and Net Investment Income Tax would also apply. Since we’re working in hypotheticals, forgive the simplification.)

If you were caught in just such a situation, this is a way you might use the tax law in your favor for a bit of hindsight tax planning. It doesn’t happen often, but this is one case where you could work the rules to your advantage.

Note: Bear in mind that I have not used this method myself or with clients, and the example I have given is purely hypothetical. If you choose to use this method, although the rules appear to be in your favor, but there are no guarantees that the IRS would agree with this. On face value I believe it will work exactly as I have written, but I have not seen any cases where this set of facts was put into play, successfully or not. Proceed at your own risk.

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.