When working with your estate planning (even if you don’t realize you are) you may run across the terms per stirpes and per capita. Choose one type over the other and you could have a significant impact on who eventually receives your estate. So what do these two terms mean?

Dictionary.com defines the two terms as follows:

per stirpes – noun; pertaining to or noting a method of dividing an estate in which the descendants of a deceased person share as a group in the portion of the estate to which the deceased would have been entitled.

per capita – noun; noting or pertaining to a method of dividing an estate by which all those equally related to the decedent take equal shares individually without regard to the number of lines of descent.

This probably seems like just so much gunk to you, so let’s look at an example.

Joe has four children, Anna, Benny, Björn, and Agnetha. Anna and Benny have no children. Björn has three boys: Neil, Alex and Geddy; while Agnetha has two boys: Peter and Eric. Joe is planning his estate and he wants to split his assets evenly among his four kids when he dies, and if the any of the kids dies before he does, he wants the grandkids to receive the share of the child that died.

Joe designates each child as an equal beneficiary of his estate, identifying each by name. He then indicates that he wishes for the grandchildren to receive a share in the event that their parent dies before Joe. He’s stuck deciding whether or not to choose per stirpes or per capita for the distribution. Typically the verbiage would be “I leave my assets to my then living descendants, per capita” or “I leave my assets to my then living descendants, per stirpes”.

Let’s look at what will happen if he chooses one type of distribution over the other.

If Joe Chooses Per Stirpes…

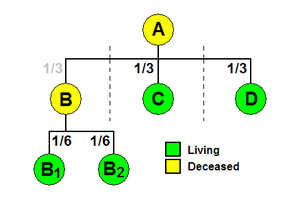

… and Anna (with no children) dies before Joe, then Benny, Björn and Agnetha will each receive 1/3 of the estate, and a share would not be created for Anna. The same would be true if Benny dies before Joe – in fact, if both Anna and Benny predecease Joe, Björn and Agnetha will receive 50% shares in the estate, and no shares would be created for Anna or Benny.

On the other hand, if Björn died before Joe, then Anna, Benny and Agnetha would each receive a 25% share, and Björn’s children, Neil, Alex and Geddy would rush to receive 8 1/3% of the estate, or Björn’s 25% share divided into thirds.

If Agnetha died before Joe, her children Peter and Eric could humbly and blindly accept 12 1/2% each, which is Agnetha’s 25% share split in two.

If any of the children of Agnetha or Björn had also predeceased Joe, the division would only be among the living grandchildren, with no provision for the deceased child. That is, unless the deceased child had children of his own, which would be Joe’s great-grandchildren, in which case the great-grandchildren would receive the share of the deceased grandchild. This would continue for all living heirs until the estate is completely distributed.

If Joe Chooses Per Capita…

… and all of the children and grandchildren survive him, each of them would receive 1/9 share. This is because per capita designates that all living descendants, by headcount, split the estate equally.

If any (or several) of the descendants of Joe have predeceased him, the shares would adjust for the remaining number of heirs. For example, if Björn died before Joe, then Anna, Benny, Agnetha, Neil, Alex, Geddy, Peter and Eric would each receive 12 1/2% of the estate. The shares would adjust for any others that predeceased Joe, or for any additional grandchildren or great-grandchildren that may have been born prior to Joe’s death.

Common usage

As you can see, per stirpes results in what most folks consider to be the most fair distribution among heirs. The inequity that comes up when these designations are used is when an heir predeceases the decedent in question (Joe from our example above), he or she would receive no share of the decedent’s estate, not even via his or her own estate. This can be rectified by naming the primary beneficiaries (Anna, Benny, Björn and Agnetha in our example), and then indicating that contingent shares could be designated to their estates if no living heirs, or to their living heirs, per stirpes.

Per capita is not used often, and it can cause some problems. Notwithstanding the fact that your children are penalized if they don’t happen to reproduce while their siblings did, when assets are transferred more than one generation away from the decedent, there can be an additional generation skipping transfer tax (GSTT) applied to the distribution. Sometimes per capita is used by generation, which can result in an even distribution among a particular generation, if that’s your intent.

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

what if the will doesn’t state either term and one of the decedent’s children predeceases him. do the deceased child’s adult children have to be named as heirs? And if so, what share are they entitled to?

Kandy, I believe that law of the state of the decedent’s death will apply to determine just how the situation you’ve described would be treated. Often one term or the other is the legal “default” in the absence of specific wording.

jb

I believe someone pressed the “GO” button too soon…

Your last sentence is copied here: “Sometimes per capita is used by generation, which”

YAK!

Nice catch, Clydewolf. I’ve updated with “the rest of the story”. :)

jb