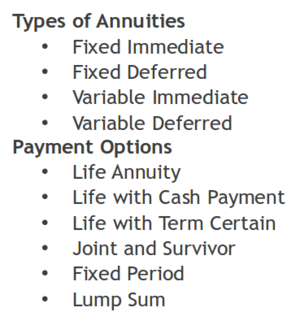

Last week we covered some of the differences in annuities and the various types of annuities someone can purchase. In our final annuity installment (no pun intended) I want to explain some of the fees and expenses that some annuities and annuity providers employ.

As mentioned in my first annuity article annuities are an insurance product – insuring against living too long. Most companies that offer annuities will charge for this insurance by means of what are called mortality and expense charges. M&E charges can be as low as .25% to as high as over 2%. These charges are the expenses the annuity company charges to the entire risk pool of policyholders in order to pay for the few that will outlive their life expectancy. Most policyholders and annuitant will not outlive their life expectancy and thus pay for those that do.

M&E charges will also help the annuity company cover other administrative expenses and a contingency for profits.

For example, let’s say you own a fixed annuity that pays 3% guaranteed interest but the M&E charges are 1.25%. Your net return for any given year is really 1.75%, not 3%.

In addition to M&E charges most annuity companies will also have pretty significant surrender charges on their products. Surrender charges are charges the policyholder pays if they cancel their contract early – usually within than 6 to 10 years. Most of this charge is to cover the commission paid to the agent or advisor selling the annuity and the insurance company must recover that commission from somewhere – and it’s usually from the policy holder. Surrender charges can be as high as 10% and gradually decline by percentage the longer you own the annuity.

Variable annuities will have additional expenses in the form of expense ratios for the mutual funds that hold the policyholder’s money. Expenses can be as low as .25% to as high as 2.5%. Generally, expense ratios will be high if you’re invested in a fund that the annuity company owns – it’s their proprietary mutual fund; and generally, they are the worst to be in.

All it takes is some simple math to realize that on average fees and expenses can be as low as .50% to as high as 4%. Some annuities will be even higher if there are added riders/benefits to the policy such as guaranteed income riders, guaranteed minimum withdrawal benefits or guaranteed interest options. But there’s no free lunch. Usually the more bells and whistles you have, the more expensive the annuity and the less interest/returns you get.

For example, if you had a variable annuity that returned 6% in a given year, if your total expenses were 4% – you only made 2%. Most of the fees and expenses are going to be buried in the prospectus, however, any good annuity salesperson should disclose the total fees as well as the surrender charges.

A few words of caution: Beware of having an IRA with an annuity wrapper. This is really overkill. Why? Annuities are tax deferred vehicles – meaning that money that accumulates inside the annuity is not taxed until it’s withdrawn. The same is true with IRAs. And be extremely cautious of having a Roth IRA within an annuity.

From a tax perspective annuities are taxed on a last in first out basis – meaning earnings are taxed first. Generally an annuity in a 401(k), 403(b) or 457 plan will be taxed entirely as ordinary income. The exception is when someone comes to the insurance company and what’s to annuitize a lump sum such as an after tax amount of money or a life insurance death benefit.

The taxation is calculated using the exclusion ratio. For example, let’s say you have $500,000 that you want to use to guarantee yourself a lifetime income stream. The annuity company says that based on your life expectancy you will live for another 20 years and will get $4,000 per month from your $500,000 initial deposit. Since $500,000 of your initial investment has already been taxed, part of the payment you receive will also not be taxed.

The calculation works like this:

$500,000/($4,000×12) x 20 years; or $500,000/$960,000. This means that 52% of the $4,000 payment ($2,080) is not subject to income tax. The remaining $1,920 is taxable. This pattern will remain as long as the annuitant is within his or her life expectancy. Should he or she live beyond 20 years, then all of the $4,000 is taxable since the $500,000 basis is exhausted.

It goes without saying that if you’re considering an annuity or more likely being pressured to buy an annuity, seek a second opinion. Be sure to ask about the annuity’s total cost including M&E charges, expense ratios (if a variable annuity) and the surrender charges. Also consider asking the salesperson how much they’ll make on the sale. If they don’t know the charges or commissions – this is a bad sign. Consider looking elsewhere.

Ask yourself and your advisor if you really need an annuity. If a pension, Social Security and your other retirement account balances will more than cover your living and retirement expenses, then an annuity may not be in your best interest. If you don’t have a pension and your Social Security and retirement income may not be enough then an annuity may be an option.

Finally, annuities are not necessarily bad. They can be an excellent hedge against outlasting your income. But they can also destroy an investor’s returns via fees and expenses. Ask lots of questions and seek the advice of a competent professional – someone whose income is not contingent on the sale of the annuity.