We’ve covered a lot of ground talking about Spousal Benefits and strategies for filing, and other facts to know about Spousal Benefits. But did you realize that there is a flaw in the process that shortchanges some couples when it comes to Spousal Benefits?

Here’s a pair of example couples to illustrate the inequity:

The first couple: Jane has worked her entire life and has earned a Social Security benefit of $2,600 per month when she retires. Her husband Sam has been a struggling artist his whole life, as well as a stay-at-home Dad to their three kids when they were young. As a result, Sam has never generated enough income on his own to receive the requisite 40 quarter-credits to have a Social Security benefit of his own.

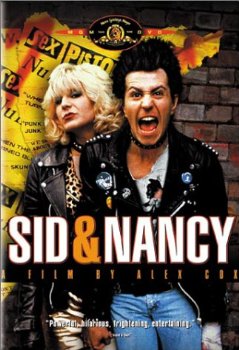

The second couple: Sid and Nancy have both worked and had earnings within the Social Security system over their lifetimes. Sid had a higher level of earnings, generating a Social Security retirement benefit of $2,600 when he’s ready to retire. Nancy operated a home-based business part-time while the kids were young, and worked outside the home for several years after they were all finished with high school. As a result, Nancy has a retirement benefit of $1,000 built up for when she’s ready to retire.

The result is this: Both couples, if they file at Full Retirement Age (FRA), will be eligible for the exact same benefit amounts. For the sake of my illustration and to keep things simple, all four individuals reach FRA at the same time.

Jane files for her own retirement benefit of $2,600. Sam, without an earnings record, can now file for the Spousal Benefit in the amount of $1,300. Altogether they will receive $3,900 per month.

Sid also files for his own retirement benefit of $2,600. Nancy then files for her own benefit of $1,000, and since she’s eligible to file for the Spousal Benefit, she will receive a Spousal Benefit offset amount of $300 – bringing her total benefit to $1,300. Altogether they will receive $3,900 per month.

Exactly the same benefit amount. Nancy receives nothing extra from Social Security for her earnings record.

One Difference

There is one difference in the options available to these two couples. Having read my columns on the subject, Sid and Nancy decide that Nancy should file a restricted application for Spousal Benefits only, which would result in the same $1,300 per month benefit. Nancy can then later, at age 70, file for her own benefit which has been increased due to Delayed Retirement Credits. This amounts to a 32% increase, which would bring her total benefit to $1,320 per month at that time.

So for her work record, Nancy can increase her overall benefit by $240 per year. Doesn’t seem fair, does it? Don’t get me wrong, I don’t think a stay-at-home parent should be penalized and receive nothing for his or her time in that critical occupation, nor do I think that spouses with low or no income should suffer either. But it does seem that there should be *some* additional benefit for the lower-earning spouse who has generated a benefit on his or her own record.

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

My husband started drawing his ss $1669.00 at age 63. He will reach FRA in FEB 2016. His benefit would have been around $2000.00 if he had waited till FRA I am only 57 & have not worked a lot through out our 20 years of marriage. My benefit at age 62 is only $722.00 If I wait till age 66, it is $1002.00 & age 70 it would be $1269.00 We are just getting by on his income with a little part time work on his part. I have found all this info you have offered very interesting. Do you have any advice to help us maximize our benefits? Thank you!

Rosa –

Unfortunately I don’t know of anything that could be done to enhance your benefits at this stage. When cash flow is an issue (meaning that you need the Social Security benefits to make ends meet) then any delay strategy would cause major problems.

Sorry I couldn’t help –

jb

It’s not especially unfair. Nancy paid social security or self employment tax to get her earnings record, Sam did not.

??? so what’s not unfair about that? Both get the same benefit, but only one paid into the system for it (a portion of it).