Photo credit: coop

There are several ways to get at your IRA funds before age 59½ without having to pay the 10% penalty. In this post we’ll cover the Medical Expenses which allow for a penalty-free distribution.

There are three different Medical reasons that can be used to qualify for an early withdrawal: high unreimbursed medical expenses, paying the cost of medical insurance, and disability. Disability and high unreimbursed medical expenses are also applicable reasons allowing for early withdrawal of 401k funds without penalty. We’ll cover each of these topics separately below.

High Unreimbursed Medical Expenses

If you are faced with high medical expenses for yourself, your spouse, or a qualified dependent, you may be eligible to withdraw some funds from your IRA or 401k penalty-free to pay for those expenses. The amount that you can withdraw is limited to the actual amount of the medical expenses you paid during the calendar year, minus 10% (7.5% if you or your spouse is age 65 or older during 2016) of your Adjusted Gross Income, or AGI. Your AGI is the amount on your Form 1040, line 38, or Form 1040A line 22.

You can only count medical expenses that are otherwise deductible as medical expenses on Schedule A of Form 1040 – but, you don’t have to itemize your deductions in order to take advantage of this exception to the 10% penalty.

For this exception to apply to withdrawals from a 401k, often you are also required to have left the employer.

Medical Insurance Premiums

You may be able to take a penalty-free distribution from your IRA (but not your 401k) to help pay for medical insurance premiums for yourself, your spouse, and your dependents, as long as the amount you withdraw does not exceed the amount you actually paid for medical insurance premiums, and all of the following apply:

- You lost your job.

- You received unemployment compensation paid under any federal or state law for 12 consecutive weeks because you lost your job.

- You receive the distributions during either the year you received the unemployment compensation or the following year.

- You receive the distributions no later than 60 days after you have been reemployed.

There is no income limitation on this provision.

Disability

If you become disabled prior to age 59½, distributions in any amount from your IRA or 401k are not subject to the 10% penalty. Your disability must be considered of a long duration (greater than one year) or expected to result in death. The disability (physical or mental) must be determined by a physician.

Keep in mind, as we mentioned previously, these avenues provide a way to withdraw funds from your IRA penalty-free, but not tax-free. You will still be liable for ordinary income tax on any distributions that you take from your deductible IRA or 401k. In addition, you will need to check with your 401k administrator to find out about the rules and limitations that are specific to your particular plan.

Did you know that even with the new Social Security rules, it’s possible to work out a strategy to maximize your Social Security benefits? There are options still available (if you were born before 1954) that can provide you with some vestiges of the old “get some now, get more later” option.

Did you know that even with the new Social Security rules, it’s possible to work out a strategy to maximize your Social Security benefits? There are options still available (if you were born before 1954) that can provide you with some vestiges of the old “get some now, get more later” option. Many folks have a 401k plan – it’s the most common sort of retirement savings vehicle that employers offer these days. But there are things about your 401k plan that you probably don’t know – and these secrets can be important to know!

Many folks have a 401k plan – it’s the most common sort of retirement savings vehicle that employers offer these days. But there are things about your 401k plan that you probably don’t know – and these secrets can be important to know! When you have a canceled debt, you may think you’re done with that old nuisance. Unfortunately, the IRS sees it otherwise. Technically, since you owed money beforehand and now you don’t, your financial situation is increased by the amount of canceled debt. When you have an increase to your financial situation, this is known as income. And income, as you know, is quite often taxable – but sometimes there are ways to exclude the canceled debt from your income for tax purposes.

When you have a canceled debt, you may think you’re done with that old nuisance. Unfortunately, the IRS sees it otherwise. Technically, since you owed money beforehand and now you don’t, your financial situation is increased by the amount of canceled debt. When you have an increase to your financial situation, this is known as income. And income, as you know, is quite often taxable – but sometimes there are ways to exclude the canceled debt from your income for tax purposes. When you have a 401k and you need some money from the account, you have a couple of options. Depending upon your 401k plan’s options, you may be able to take a 401k loan. With some plans you also have the option to take an early, in-service withdrawal from the plan.

When you have a 401k and you need some money from the account, you have a couple of options. Depending upon your 401k plan’s options, you may be able to take a 401k loan. With some plans you also have the option to take an early, in-service withdrawal from the plan. Sometimes the answer to our stresses in life is to get back to basics and figure out what’s important to us, as well as what things we can control in our life. In the song quoted above, Fogerty’s writing was most likely tempered by his recent discharge from the Army Reserve (1967), after which the protagonist explores an awakening to a simpler side of life, and what turns out to be important to him.

Sometimes the answer to our stresses in life is to get back to basics and figure out what’s important to us, as well as what things we can control in our life. In the song quoted above, Fogerty’s writing was most likely tempered by his recent discharge from the Army Reserve (1967), after which the protagonist explores an awakening to a simpler side of life, and what turns out to be important to him.

When filling out your tax return, it’s allowable to deduct the amount of your regular IRA contribution when filing even though you may not have already made the contribution.

When filling out your tax return, it’s allowable to deduct the amount of your regular IRA contribution when filing even though you may not have already made the contribution. When a child has unearned income from investments in his or her own name, taxes can be a bit tricky. Depending on how much the unearned income is, part of it may be taxed at the child’s parent’s tax rate, for example.

When a child has unearned income from investments in his or her own name, taxes can be a bit tricky. Depending on how much the unearned income is, part of it may be taxed at the child’s parent’s tax rate, for example. Last week my article

Last week my article

Unless you’ve been under a rock for the past several years, you know that this time of year is tax season. If you haven’t already filed your 2015 income tax return, of course you’ve got some work ahead of you. Unfortunately filing your tax return often results in errors – and these can be quite costly in terms of delays in processing as well as potential penalties and interest if your error results in underpayment of tax.

Unless you’ve been under a rock for the past several years, you know that this time of year is tax season. If you haven’t already filed your 2015 income tax return, of course you’ve got some work ahead of you. Unfortunately filing your tax return often results in errors – and these can be quite costly in terms of delays in processing as well as potential penalties and interest if your error results in underpayment of tax. If you take a 401k withdrawal and the money in the 401k was deducted from your taxable income, you’ll be taxed on the funds you withdraw. Depending on the circumstances, you may also be subject to a penalty. There’s a lot of confusion about how the taxation works – and the taxation and penalties can be different depending upon the circumstances.

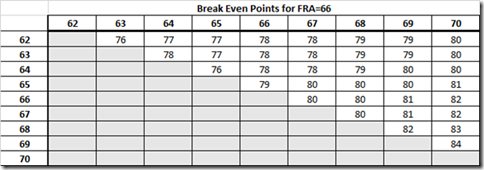

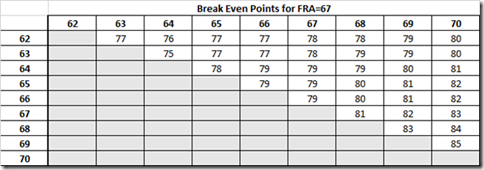

If you take a 401k withdrawal and the money in the 401k was deducted from your taxable income, you’ll be taxed on the funds you withdraw. Depending on the circumstances, you may also be subject to a penalty. There’s a lot of confusion about how the taxation works – and the taxation and penalties can be different depending upon the circumstances. Much has been written and discussed regarding the option to file a Restricted Application for Social Security spousal benefits, but there are still many, many questions. This article is an attempt at covering all of the bases for you with regard to restricted application.

Much has been written and discussed regarding the option to file a Restricted Application for Social Security spousal benefits, but there are still many, many questions. This article is an attempt at covering all of the bases for you with regard to restricted application.

There is a great deal of confusion surrounding the new Social Security rules that were put into place with the Bipartisan Budget Act of 2015 (BBA15). The part that is bothering folks the most right now is the deadline that is coming up, on April 30, 2016.

There is a great deal of confusion surrounding the new Social Security rules that were put into place with the Bipartisan Budget Act of 2015 (BBA15). The part that is bothering folks the most right now is the deadline that is coming up, on April 30, 2016. Many taxpayers are receiving a new form in the mail this tax season – Form 1095, either A, B, or C. This is because of the Obamacare law which requires that taxpayers have healthcare coverage. Form 1095 provides documentation of the taxpayer’s coverage by healthcare insurance. Depending upon the type of coverage you have, you will receive a certain type of form. And what should you do with this form?

Many taxpayers are receiving a new form in the mail this tax season – Form 1095, either A, B, or C. This is because of the Obamacare law which requires that taxpayers have healthcare coverage. Form 1095 provides documentation of the taxpayer’s coverage by healthcare insurance. Depending upon the type of coverage you have, you will receive a certain type of form. And what should you do with this form? When the Bipartisan Budget Act of 2015 was passed, there were a few changes made to Social Security rules. One of the rules that changed significantly is the deemed filing rule.

When the Bipartisan Budget Act of 2015 was passed, there were a few changes made to Social Security rules. One of the rules that changed significantly is the deemed filing rule. Recently the IRS issued a memo regarding the recent uptick in the occurrence of email phishing scams this year. Below is the text of the warning memo (IR-2016-28):

Recently the IRS issued a memo regarding the recent uptick in the occurrence of email phishing scams this year. Below is the text of the warning memo (IR-2016-28):

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.