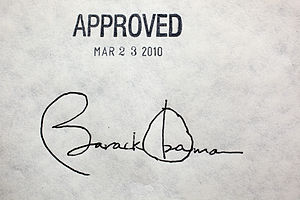

Note: This is a dust-off of an article written in April 2010 that dealt with the special two-year taxation of Roth Conversions that was available in that year. An astute reader noted that the original was a bit dusty and not applicable to today’s decision-making (thanks S!).

One of the provisions of the Affordable Care Act is a new tax – a surtax on investment income over certain amounts. This surtax has come into play this year, for tax returns filed in 2014 on 2013 income. The income amounts are, admittedly, rather high, but nonetheless will likely impact a lot of folks. What you may not realize is that, due to the application of this surtax, Roth IRA conversion strategies that you may have had in play may be impacted. Depending upon your overall income, you may have to pay the surtax on some or all of your conversion amount. On the other hand, by converting, in the future you could avoid surtax, and likely reduce the bracket that you have to pay from for all income.

The New 3.8% Surtax

Here’s how the new 3.8% surtax is applied: a tax will be imposed for each taxable year, equal to 3.8% of the lesser of 1) net investment income; or 2) the excess of Modified Adjusted Gross Income over the threshold amount. So, in order to understand what this means, we need to define a few things.

Net Investment Income – this is the total of all interest, dividends, annuities, rents, royalties, income from passive activities, and net capital gains from disposition of capital property not held in an active trade or business. The IRS has specifically excluded the following from Net Investment Income:

- Income (including self-employment income)

- Distributions from IRAs or other qualified plans

- Gain on the sale of an active interest in an S Corporation or partnership

- Items that are otherwise excluded from income, such as interest from tax-exempt bonds

Modified Adjusted Gross Income – for the purpose of the surtax, this is simply your Adjusted Gross Income (Form 1040 line 37) plus the net amount related to the foreign earned income exclusion.

NOTE: THIS IS NOT THE SAME AS THE MAGI THAT YOU USE TO DETERMINE YOUR ELIGIBILITY FOR VARIOUS IRA DEDUCTIONS OR CONTRIBUTIONS. You can find that calculation by reading “Determining Your MAGI”. Don’t confuse the two, as they are completely different calculations – thanks, IRS! To keep the confusion at a minimum, I will explicitly refer to this Modified Adjusted Gross Income as Modified AGI within this surtax context.

Thresholds – the thresholds for applying the surtax are as follows:

- $250,000 for filing status of Married Filing Jointly

- $125,000 for filing status of Married Filing Separately

- $200,000 for filing status of Single or Head of Household (yes, Virginia, it is more tax efficient to be single)

Examples

Now that we know the definitions, let’s look at a couple of examples to see how the surtax would be applied:

Example 1. Joe and Mary, a married couple filing jointly, have net investment income of $50,000 and pension income of $125,000. They are also strategically converting distributions from their IRA to Roth annually in the amount of $100,000, which brings their Modified AGI to $275,000. So in 2013 Joe and Mary will be subject to the surtax on the lesser of their net investment income ($50,000) or the amount of their Modified AGI over the threshold ($275,000 minus $250,000 equals $25,000).

In this case, the amount of the Modified AGI over the threshold is the lesser amount, and so Joe and Mary will have to pay the surtax on $25,000, or $950 in surtax.

Example 2. Les, a single taxpayer, also has net investment income of $50,000, and pension and other income of $155,000. Les also is converting amounts each year from his IRA to Roth, in the amount of $50,000 annually. Les’s Modified AGI, combining of all of this income, is $255,000, which is over the threshold. Applying the calculation, Les will owe the surtax on $50,000 – which is the lesser of his two amounts (Modified AGI of $255,000 minus $200,000 threshold equals $55,000, which is greater than his net investment income of $50,000). The surtax will be $1,900.

How a Roth IRA Conversion Strategy Could Be Impacted

You’ve undoubtedly heard about Roth IRA conversions – where you move money from a traditional IRA or 401(k) plan to a Roth IRA, paying income tax on the pre-tax amount moved. This overall concept should be considered by all folks who have IRAs, especially folks with higher incomes. This is especially true if future (taxable) distributions from traditional IRAs will have an impact on your tax bracket – and potentially cause the surtax to be applied.

When the money is moved to a Roth IRA, there are no future Required Minimum Distributions (RMDs) from the Roth IRA account during your lifetime, whereas if the money is in a traditional IRA when you reach age 70½ you will be forced to withdraw funds (via RMDs) from your IRA and pay tax on it in that year. Plus, any amount that you withdraw from the Roth IRA in the future will not be taxed, and therefore will not impact the calculations for the surtax.

In Example 1 above, the only reason the surtax was applied at all was because of the IRA distribution for conversion. If Joe and Mary had completed the conversion of the $500,000 in IRAs to Roth IRA in prior years, they would have paid tax on the conversion in each year of conversion. This would mean that for 2013 they would not have Modified AGI above the threshold, so they would not owe the surtax.

If they waited until 2013 to do a total conversion, they’d have Modified AGI of $675,000 – with a pretty hefty income tax and surcharge applied. However, if they adjusted their conversion amounts to only $75,000 for 2013 their Modified AGI would be exactly $250,000, so they wouldn’t owe the surtax. Keeping up at the rate of $75,000 per year, they’d have their IRAs converted to Roth within the coming 7 years, eliminating RMDs from their future income – but since they wouldn’t be subject to the surtax from future RMDs, they might opt to discontinue Roth Conversions at this stage and opt to take future RMDs at a much smaller pace. This could result in lower overall taxes for the couple.

In Example 2, Les was already going to be subject to the surtax even without the IRA distribution. If we assume that Les also had $500,000 in his IRA account, converting that amount to a Roth IRA would result in a Modified AGI of $705,000, again with a hefty tax bill and surtax. Unlike the Example 1 couple, Les can’t make an adjustment to his Roth Conversion amounts to eliminate the surtax. But he might want to continue with his conversion activity nonetheless in order to eventually eliminate the additional amounts being withdrawn via RMDs. Like most Roth Conversions, a decision must be made as to whether or not you believe future taxes will be more or less than the current rates.

Conclusion

While the surtax on its own should not be a reason to enact a Roth IRA conversion strategy, one of the tenets that we’ve talked about in the past that can cause the conversion to work in your favor is a future increase in tax rates. If you believe that future taxes are likely to be higher (and let’s face it, who doesn’t believe this?) then any amounts that you can afford to convert should be considered now. The surtax just gives you more reason to consider it.

Photo by alancleaver_2000

Given the way that Social Security benefits are calculated, it should come as no surprise that increasing your income over time will make a difference in your eventual Social Security retirement benefits. But how much of a difference does it make when your income is increased?

Given the way that Social Security benefits are calculated, it should come as no surprise that increasing your income over time will make a difference in your eventual Social Security retirement benefits. But how much of a difference does it make when your income is increased?

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.