Photo credit: dido

It is important to understand the Pro-Rata rule for IRAs – which comes into play when you have both deductible and after-tax contributions in your Traditional IRA account. As you take distributions from the account, each distribution is treated as partly taxable and partly non-taxable, in proportion of the after-tax contributions related to the overall account balance.

So How Does The Pro-Rata Rule Work?

For an example, let’s say you have a Traditional IRA (TIRA) with a balance of $100,000. Over the years you made both deductible and after-tax contributions to this account… and your after-tax contributions amount to $25,000. It’s not necessary to know the amount of the deductible contributions (for this exercise), just the after-tax contributions.

For this tax year, you’ve chosen to take distribution of $10,000 from your TIRA. When you prepare your tax return next year, you’ll include $7,500 in ordinary income, excluding the $2,500 which is the proportionate amount of your distribution representing your after-tax contributions. In this example, one dollar out of every four is considered return of your after-tax contributions.

That’s pretty simple, right? So why is this deemed worthy of a whole blog post? Hold your horses, I’m about to tell you…

Why This Is Worthy Of A Whole Blog Post?

This is especially important when planning your Roth IRA conversions, among other distributions. When you do a conversion, this is essentially a distribution from your TIRA, and as such you are liable for ordinary income tax on the taxable portion of your distribution.

This is one of the reasons that well-meaning financial advisors often recommend that, if you’re going to make non-deductible contributions to a TIRA with the intent to convert the account to a RIRA, you should make them to a completely separate account. This way, (presumably) the only portion that would be taxable at the distribution (conversion) would the be the growth of the funds, such as capital appreciation and dividends.

Unfortunately, that’s not the way it works. The pro-rata rule takes into account the balance and makeup of ALL of your Traditional IRA accounts, not just the one that you’re taking a distribution from.

For example, Joe has $50,000 in one Traditional IRA account (from only pre-tax contributions). Joe’s income is too high for him to make Roth IRA contributions or deductible Traditional IRA contributions. He’s heard of the “back-door Roth IRA contribution” strategy, and would like to put this into play for his situation. Joe opens a new Traditional IRA and contributes $5,500 to the account. This contribution is non-deductible to Joe.

Now, following the back-door strategy, Joe converts his entire new IRA over to a Roth IRA. He thinks he has done this with no tax. But the problem is in the way the pro-rata rule works. Joe must pay tax on his conversion in proportion to the total of all of his IRA account balances, less the portion that is after-tax.

Adding his two IRAs together, he has a total of $55,500 in IRAs before the conversion. Of this, only 9.9% is after-tax contributions ($5,500 divided by $55,500). So of his converted $5,500, he must pay tax on $4,954.95 (90.1%). Plus, he still has $4,954.95 of non-deductible contributions that he must continue to keep track of as he makes future distributions from the account.

This can cause a lot of headache since there may be many years between the initial contribution and final distribution from the account. For each year that you have non-deductible contributions in your IRAs, you should track these contributions via IRS Form 8606, even if you have not taken any distributions for the year. This will keep your records up-to-date for when you do take distributions later on.

But I want to only convert the after-tax portion!

There is still a way to convert only the after-tax amounts to a Roth IRA, but there are some restrictions as well.

If you have access to a 401(k) plan or other employer-sponsored retirement plan (other than an IRA) that will accept rollover amounts (you’ll have to check this with your plan sponsor, some do not accept rollovers), you may be allowed to rollover the amount from your IRA that represents everything but your after-tax contributions. Make sure you don’t accidentally rollover the post-tax (nondeductible) contributions, because that’s not allowed and you could get into dutch with the IRS and your 401k administrator if you do. However, if you can rollover everything but the non-deductible contributions, then you can convert the remainder amounts to your Roth IRA without a taxable event. Pretty cool, huh?

It’s important to note that this only works for 401(k), 403(b) and other employer-sponsored retirement plans. You can’t rollover the excess above the non-deducted contributions to another IRA – you’d still be in the same boat as before.

All of these transactions can carry significant tax penalties if you make a mistake, so you need to be doubly sure that you’re doing it right before you make a move. There are no “do overs” for these transactions (well, not without jumping through hoops or other places that you don’t want to consider). Consult your tax advisor to make sure you’re doing it correctly if you’re not sure.

There’s a big difference between income and wealth. Income can be considered the amount of money an individual earns on a consistent basis. For most individuals, this is a paycheck. Wealth can be considered an individual’s net worth, or, more specifically, how much income their wealth generates and how long they can sustain a given lifestyle without having to receive a conventional paycheck.

There’s a big difference between income and wealth. Income can be considered the amount of money an individual earns on a consistent basis. For most individuals, this is a paycheck. Wealth can be considered an individual’s net worth, or, more specifically, how much income their wealth generates and how long they can sustain a given lifestyle without having to receive a conventional paycheck.

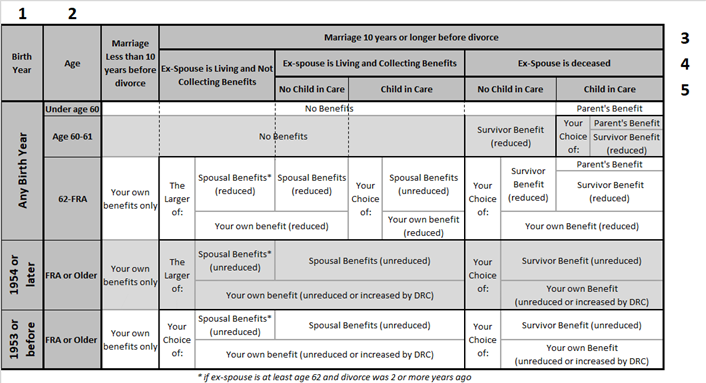

As you learn about Social Security and your possible benefits, there are several unique Social Security terms that you should understand. Below is a list and brief definitions of the most important of these Social Security terms.

As you learn about Social Security and your possible benefits, there are several unique Social Security terms that you should understand. Below is a list and brief definitions of the most important of these Social Security terms.

1/1/2018 Note: Recharacterization of Roth conversion is no longer allowed as of tax year 2018. The last tax year that you could recharacterize Roth conversions is 2017. See

1/1/2018 Note: Recharacterization of Roth conversion is no longer allowed as of tax year 2018. The last tax year that you could recharacterize Roth conversions is 2017. See

There is a set of Rights that are available to all of us as taxpayers – the Taxpayer Bill of Rights. This group of basic rights is available to us so that the government (and specifically the Treasury Department and the IRS) don’t over-step their boundaries when dealing with taxpayers.

There is a set of Rights that are available to all of us as taxpayers – the Taxpayer Bill of Rights. This group of basic rights is available to us so that the government (and specifically the Treasury Department and the IRS) don’t over-step their boundaries when dealing with taxpayers.

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.