When you have a canceled debt, you may think you’re done with that old nuisance. Unfortunately, the IRS sees it otherwise. Technically, since you owed money beforehand and now you don’t, your financial situation is increased by the amount of canceled debt. When you have an increase to your financial situation, this is known as income. And income, as you know, is quite often taxable – but sometimes there are ways to exclude the canceled debt from your income for tax purposes.

When you have a canceled debt, you may think you’re done with that old nuisance. Unfortunately, the IRS sees it otherwise. Technically, since you owed money beforehand and now you don’t, your financial situation is increased by the amount of canceled debt. When you have an increase to your financial situation, this is known as income. And income, as you know, is quite often taxable – but sometimes there are ways to exclude the canceled debt from your income for tax purposes.

The IRS recently issued a Tax Tip (Tax Tip 2016-30) which details some important information that you need to know about canceled debt, including HAMP modifications and other items. The actual text of the Tip follows:

Top 10 Tax Tips about Debt Cancellation

If your lender cancels part or all of your debt, it is usually considered income and you normally must pay tax on that amount. However, the law allows an exclusion that may apply to homeowners who had their mortgage debt canceled. Here are 10 tips about debt cancellation:

1. Main Home. If the canceled debt was a loan on your main home, you may be able to exclude the canceled amount from your income. You must have used the loan to buy, build or substantially improve your main home to qualify. Your main home must also secure the mortgage.

2. Loan Modification. If your lender canceled part of your mortgage through a loan modification or ‘workout,’ you may be able to exclude that amount from your income. You may also be able to exclude debt discharged as part of the Home Affordable Modification Program, or HAMP. The exclusion may also apply to the amount of debt canceled in a foreclosure.

3. Refinanced Mortgage. The exclusion may apply to amounts canceled on a refinanced mortgage. This applies only if you used proceeds from the refinancing to buy, build or substantially improve your main home and only up to the amount of the old mortgage principal just before refinancing. Amounts used for other purposes do not qualify.

4. Other Canceled Debt. Other types of canceled debt such as second homes, rental and business property, credit card debt or car loans do not qualify for this special exclusion. On the other hand, there are other rules that may allow those types of canceled debts to be nontaxable.

5. Form 1099-C. If your lender reduced or canceled at least $600 of your debt, you should receive Form 1099-C, Cancellation of Debt, by Feb. 1. This form shows the amount of canceled debt and other information.

6. Form 982. If you qualify, report the excluded debt on Form 982, Reduction of Tax Attributes Due to Discharge of Indebtedness. File the form with your federal income tax return.

7. IRS.gov Tool. Use the Interactive Tax Assistant tool on IRS.gov to find out if your canceled mortgage debt is taxable.

8. Exclusion Extended. The law that authorized the exclusion of canceled debt from income was extended through Dec. 31, 2016.

9. IRS Free File. IRS e-file is fastest, safest and easiest way to file. You can use IRS Free File to e-file your tax return for free. If you earned $62,000 or less, you can use brand name tax software. The software does the math and completes the right forms for you. If you earned more than $62,000, use Free File Fillable Forms. This option uses electronic versions of IRS paper forms. It is best for people who are used to doing their own taxes. Free File is available only on IRS.gov/freefile.

10. More Information. For more on this topic see Publication 4681, Canceled Debts, Foreclosures, Repossessions and Abandonments.

Each and every taxpayer has a set of fundamental rights they should be aware of when dealing with the IRS. These are your Taxpayer Bill of Rights. Explore your rights and our obligations to protect them on IRS.gov.

Additional IRS Resources:

- Tax Topic 431 – Canceled Debt – Is It Taxable or Not?

- Home Foreclosure and Debt Cancellation

When you have a 401k and you need some money from the account, you have a couple of options. Depending upon your 401k plan’s options, you may be able to take a 401k loan. With some plans you also have the option to take an early, in-service withdrawal from the plan.

When you have a 401k and you need some money from the account, you have a couple of options. Depending upon your 401k plan’s options, you may be able to take a 401k loan. With some plans you also have the option to take an early, in-service withdrawal from the plan. Although many individuals have various risk management policies in place, sometimes those policies get brushed aside and every once in a while the dust needs to be wiped off of them and perhaps some updating needed. Here’s a checklist to consider the next time you review your risk management strategies.

Although many individuals have various risk management policies in place, sometimes those policies get brushed aside and every once in a while the dust needs to be wiped off of them and perhaps some updating needed. Here’s a checklist to consider the next time you review your risk management strategies. Sometimes the answer to our stresses in life is to get back to basics and figure out what’s important to us, as well as what things we can control in our life. In the song quoted above, Fogerty’s writing was most likely tempered by his recent discharge from the Army Reserve (1967), after which the protagonist explores an awakening to a simpler side of life, and what turns out to be important to him.

Sometimes the answer to our stresses in life is to get back to basics and figure out what’s important to us, as well as what things we can control in our life. In the song quoted above, Fogerty’s writing was most likely tempered by his recent discharge from the Army Reserve (1967), after which the protagonist explores an awakening to a simpler side of life, and what turns out to be important to him.

When filling out your tax return, it’s allowable to deduct the amount of your regular IRA contribution when filing even though you may not have already made the contribution.

When filling out your tax return, it’s allowable to deduct the amount of your regular IRA contribution when filing even though you may not have already made the contribution. When a child has unearned income from investments in his or her own name, taxes can be a bit tricky. Depending on how much the unearned income is, part of it may be taxed at the child’s parent’s tax rate, for example.

When a child has unearned income from investments in his or her own name, taxes can be a bit tricky. Depending on how much the unearned income is, part of it may be taxed at the child’s parent’s tax rate, for example. Last week my article

Last week my article

Unless you’ve been under a rock for the past several years, you know that this time of year is tax season. If you haven’t already filed your 2015 income tax return, of course you’ve got some work ahead of you. Unfortunately filing your tax return often results in errors – and these can be quite costly in terms of delays in processing as well as potential penalties and interest if your error results in underpayment of tax.

Unless you’ve been under a rock for the past several years, you know that this time of year is tax season. If you haven’t already filed your 2015 income tax return, of course you’ve got some work ahead of you. Unfortunately filing your tax return often results in errors – and these can be quite costly in terms of delays in processing as well as potential penalties and interest if your error results in underpayment of tax. If you take a 401k withdrawal and the money in the 401k was deducted from your taxable income, you’ll be taxed on the funds you withdraw. Depending on the circumstances, you may also be subject to a penalty. There’s a lot of confusion about how the taxation works – and the taxation and penalties can be different depending upon the circumstances.

If you take a 401k withdrawal and the money in the 401k was deducted from your taxable income, you’ll be taxed on the funds you withdraw. Depending on the circumstances, you may also be subject to a penalty. There’s a lot of confusion about how the taxation works – and the taxation and penalties can be different depending upon the circumstances.

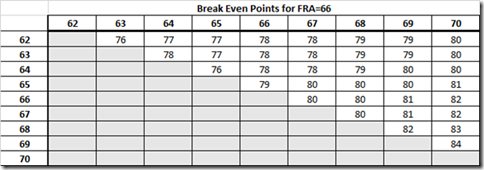

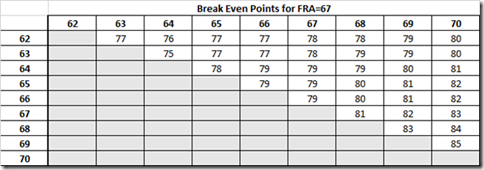

Much has been written and discussed regarding the option to file a Restricted Application for Social Security spousal benefits, but there are still many, many questions. This article is an attempt at covering all of the bases for you with regard to restricted application.

Much has been written and discussed regarding the option to file a Restricted Application for Social Security spousal benefits, but there are still many, many questions. This article is an attempt at covering all of the bases for you with regard to restricted application.

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.