Photo credit: nan

These days you’re pretty much on your own when it comes to planning for your retirement. Granted, many state and local governments have a pension plan, but beyond that, precious few employers provide a pension these days. Typically retirement benefits only include a 401(k) or other deferred retirement plan, which means it’s up to you! For the purpose of brevity, I’ll refer to 401(k) plans throughout this article; please understand that most of the information applies to 403(b) plans, 401(a) plans, and 457 plans as well as Keogh, SIMPLE, and SEP IRA plans.

For most of us, the 401(k) is the default account that must take on the role that the pension plan did for previous generations. Paying attention to and avoiding the following mistakes can help you to ensure that you have a financially-secure future.

#1 – Choosing Not to Participate

It’s amazing how many folks, young or old, don’t participate in their company’s 401(k) plan. If your employer matches your contributions, you’re effectively giving money away. You wouldn’t do that with a raise or a tax cut, would you? And even if your employer doesn’t match your contributions, the tax savings should be enough to spark your interest… If you’re not presently participating in your company-offered 401(k) plan, bear in mind that time is your greatest ally when it comes to building up your savings. Starting early and making regular contributions to your account will have an enormous impact on the results when you’re ready to begin using these funds in retirement.

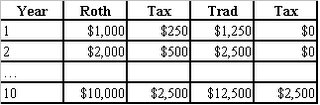

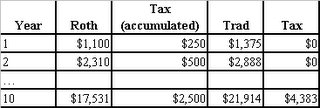

For example, if you only put $1,000 into your account at age 25, with a compound rate of return of 6%, by age 65 your account would be worth over $10,000. By the same token, if you’d waited until age 30 to make that $1,000 deposit, by age 65 it would only have grown to $7,600. That’s roughly a 30% difference only because you delayed for 5 years!

If you put $1,000 aside each year beginning at age 25, at the example 6% return when you reach age 65 this would have grown to $154,000+. And if you delay 5 years, the result is $111,000, a difference of $43,000 for your extra $5,000 of deposits.

#2 Not Having a Plan

Blindly allocating your investments can have significant consequences as well. I have reviewed retirement plans where the participant believed that they were doing the right thing by “diversifying” across every fund choice in their plan. This results in diversification all right, but doesn’t take into account the time horizon for the investment, your own risk tolerance, and other factors. And most importantly, the diversification is not necessarily among different types of assets, only among different funds in most cases.

An acquaintance, age 26, had a conservative portfolio of investments in his account – amounting to more than 80% in bonds and fixed instruments. At that age, even the most conservative of investment plans should have you above a 50% ratio in equities, in order to take advantage of long-term stock market returns. Granted, stocks are more volatile than bonds and fixed income investments, but with a longer time horizon, bonds and fixed income investments can barely keep up with inflation, let alone provide any measure of growth. In addition, the longer time horizon provides the time to ride out any “bumps” in the market that may take place.

It makes good sense to analyze your potential investment choices, consider your time horizon, your risk tolerance, and ultimately your investment “mix”, in order to create a plan for your investments that will carry you toward that holy grail of investment success – a fruitful retirement.

#3 Set It and Forget It

While we shouldn’t obsess over every single market move every single day, we also shouldn’t make our investment and contribution decisions once and then leave them for 20, 30 or 40 years. Over time, your various investments are going to grow at different rates, eventually causing one or more of your holdings to become overweighted (with regard to your planned “mix”).

I generally recommend reviewing your quarterly statements just to see how things are going in your account, and choose one of the quarters to make rebalancing moves annually as needed. These rebalancing moves don’t need to be done until one or more of your investments gets to a 5% or more variance from your plan.

#4 Taking Out a Loan

This falls into the category of things you *can* do but shouldn’t. Kinda like jumping off a cliff. What happens here is that your contribution program goes on hold as you pay back the loan, and if you don’t pay it back, you’ll owe tax and penalties. In addition, you’re paying back your tax-deferred fund with after-tax dollars, which will eventually be taxed again when you withdraw the funds at retirement. In only the most extreme of circumstances should you consider this kind of loan – honestly, you’ll regret it if you do it in most cases.

Many parents make the decision that after their child is born one parent will stay at home to be with the child. Some of the reasons include saving on daycare expenses, and wanting at least one parent to bond and be with the child during those precious first few years of development.

Many parents make the decision that after their child is born one parent will stay at home to be with the child. Some of the reasons include saving on daycare expenses, and wanting at least one parent to bond and be with the child during those precious first few years of development.

You may have a vacation home that you only spend a small amount of time at each year, and the rest of the time you rent the home out to other folks who wish to vacation in your little slice of heaven. The rents that you receive is considered taxable income, to the extent that it exceeds the applicable expenses. Plus, if the vacation home is partly used for your own purposes, the expenses (allocated to the time the property is rented) cannot exceed the amount of rent income from the property (you can’t claim a loss). here are some tips on

You may have a vacation home that you only spend a small amount of time at each year, and the rest of the time you rent the home out to other folks who wish to vacation in your little slice of heaven. The rents that you receive is considered taxable income, to the extent that it exceeds the applicable expenses. Plus, if the vacation home is partly used for your own purposes, the expenses (allocated to the time the property is rented) cannot exceed the amount of rent income from the property (you can’t claim a loss). here are some tips on

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.