Over that last week I’ve had the chance to talk more in depth and think about the word perspective. In other words, how do we look at things? How do we see the world? Granted this may be pretty deep for a financial blog, however perspective is important when it comes to finances.

Here are few examples to ponder:

- A millionaire does his or her best to legally reduce their tax bill and some would say that they are making too much money and should pay more in taxes. Looking at it differently the millionaire gave several hundreds of thousands of dollars away to charity (thus reducing their tax bill) and they are a philanthropist.

- A person investing in the market watches it crash and liquidates their entire portfolio. Another investor sees this as the market trading at fire-sale prices and buys as much as they can – buying low, often from the investor selling low to liquidate.

- A husband says that he doesn’t want or need life insurance because he doesn’t want his wife to be rich when he dies. Another husband buys as much as he can so his wife is financially secure when he’s gone.

These examples reflect the glass half-full/half-empty mentality. How we feel and respond to things is a direct reflection of how we perceive them. Sometimes we need to look at things differently to change our perspective. By looking at things differently, we open the doors for opportunity and can minimize loss.

Here’s a personal example. I love to garden. Some years ago I had planted a raspberry patch. Over time the canes spouted growth and started to throw off blossoms. For a period of about two weeks, I didn’t check on them and went out one day to see if there were any berries. To my dismay, there was gorgeous, lush green foliage but no sign of berries. I was disappointed. Dejected, I started walking away when something stopped me and I felt compelled to go back to the patch but look at it differently.

As silly as it was, I got down on my hands and knees and then laid on my back. I scooted under the leaves like a mechanic about to change oil in a car. My neighbors must have thought it was funny seeing only a lush green berry patch and feet sticking out! When I looked up all I saw was red! Berries everywhere!

By changing how I looked at things I went from dismay to over 3 gallons of berries. Imagine if I wouldn’t have looked – wasted berries (but happy rabbits).

So what are we wasting, missing out on, and losing by not changing our perspective?

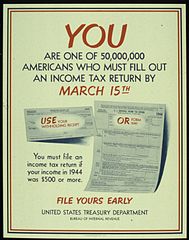

When filing your tax return you want to make sure that you don’t make mistakes. Mistakes can be costly in terms of additional tax and penalties, as well as the extra time and grief they can cause you. Most of the time using e-filing software can help you to avoid these mistakes, but you should check over the return anyhow to make certain you haven’t fat-fingered something or if something didn’t go wrong with the software.

When filing your tax return you want to make sure that you don’t make mistakes. Mistakes can be costly in terms of additional tax and penalties, as well as the extra time and grief they can cause you. Most of the time using e-filing software can help you to avoid these mistakes, but you should check over the return anyhow to make certain you haven’t fat-fingered something or if something didn’t go wrong with the software.

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.