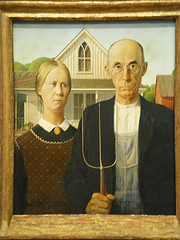

Many young individuals and couples think that the time to start thinking about estate planning is when they’re older, or perhaps if they ever have “estates”. On other occasions, the impetus to plan may be due to a recent death of a friend or family member without an estate plan or as my friend Tom, an estate planning attorney says, “Right before they take a trip over water.”

Many young individuals and couples think that the time to start thinking about estate planning is when they’re older, or perhaps if they ever have “estates”. On other occasions, the impetus to plan may be due to a recent death of a friend or family member without an estate plan or as my friend Tom, an estate planning attorney says, “Right before they take a trip over water.”

However, many young individuals should start thinking and “doing” some estate planning right away. Before we get to specific recommendation, let us first understand what estate planning is – and, what your “estate” is.

Essentially, your estate is everything you own. This includes your home, personal property, life insurance policies, invested assets, etc. Deciding how these assets are controlled and divided in the event of your death is called estate planning. Additionally, estate planning includes who will care for your children if you die, and who may make decisions on your behalf should you become incapacitated. More complex estate planning may involve legal aspects of trusts, taxation, gifting, etc.

Dying without a will (intestate) leaves the decision of how your assets will be divided, and more importantly, the guardianship of your children in the hands of the laws of the state you’re domiciled. This can lead to individuals inheriting your assets and caring for your children that you’d rather not. To prevent this individuals and couples can take steps now in order to make sure their requests are followed.

The following documents should be considered by everyone concerning estate planning.*

- A Will. Executing a will ensures that your assets are distributed to those individuals you want to inherit or disinherit your assets. Additionally, a will establishes who will be guardian of your children should both parents pass away. A will also determines the executor of your estate and may establish a trust for assets in order to provide monetary support for your children.

- Power of Attorney for Health Care. This document names a specific individual to make health care decisions on your behalf should you become incapacitated and can no longer make those decisions on your own. Readers in the state of Illinois can find a great example of a health care POA here.

- Power of Attorney for Property. Similar to the health care POA, the POA for property enables an individual you appoint to make property decisions on your behalf. Such transactions include real estate, investments, banking and taxation. Again, Illinois readers can find a great example here.

- A Living Will. A living will states your desire to have or not to have death-delaying procedures implemented in the event of your diagnosis of a terminal condition by a health care professional (your attending physician). This document assures your wishes will be followed in the event you’re unable to actively make that decision. Another excellent example for IL readers can be found here.

- Beneficiary Designations. It’s important to make sure your beneficiary designations are up to date ion your life insurance policies, annuities, retirement accounts and other investment accounts.

It goes without saying that in addition to having these documents prepared and available, individuals should talk to their family or individuals they want to have these responsibilities about their wishes, requests and potential responsibilities. Personally, and as a planner, I’ve seen families argue, fight, and ultimately discontinue speaking due to lack of communication when estate planning.

*Note: We recommend consulting a competent estate planning attorney for all of the above. The documents listed are merely examples and should not be considered replacements for professional, legal advice.

Many employers are now offering a Roth 401k option in addition to the traditional 401k option. And with this new choice comes many questions: What is the benefit? Is a Roth 401k a good idea for me? How can I choose between the traditional 401k and the Roth?

Many employers are now offering a Roth 401k option in addition to the traditional 401k option. And with this new choice comes many questions: What is the benefit? Is a Roth 401k a good idea for me? How can I choose between the traditional 401k and the Roth?

The IRS recently published their Summertime Tax Tip 2016-24, entitled “Looking for Work May Impact Your Taxes”, with some good tips that you should know as you go about job hunting. The text of the actual publication from the IRS follows, and at the end of the article I have added a few additional job-related tax breaks that could be useful to you.

The IRS recently published their Summertime Tax Tip 2016-24, entitled “Looking for Work May Impact Your Taxes”, with some good tips that you should know as you go about job hunting. The text of the actual publication from the IRS follows, and at the end of the article I have added a few additional job-related tax breaks that could be useful to you. Previously I wrote about the

Previously I wrote about the

When your spouse dies there are a few things that happen to your Social Security benefits that you need to be aware of. These things will affect your benefits significantly if your own benefit is less than that of your late spouse’s benefit (or Primary Insurance Amount). These changes to available benefits could also result in increased benefits if your own benefit is the larger of the two.

When your spouse dies there are a few things that happen to your Social Security benefits that you need to be aware of. These things will affect your benefits significantly if your own benefit is less than that of your late spouse’s benefit (or Primary Insurance Amount). These changes to available benefits could also result in increased benefits if your own benefit is the larger of the two.

When you rollover funds from one retirement plan to another, a missed rollover occurs if you can’t complete the rollover within 60 days. A missed rollover results in a taxable distribution. However, there have always been certain

When you rollover funds from one retirement plan to another, a missed rollover occurs if you can’t complete the rollover within 60 days. A missed rollover results in a taxable distribution. However, there have always been certain  If you’re like most folks, when you look at a 401k plan’s options you’re completely overwhelmed. Where to start? Of course, the starting point is to sign up to participate – begin sending a bit of your paycheck over to the 401k plan. A good place to start on that is at least enough to get your employer’s matching funds, however much that might be. In this article though, we’re looking at investing your 401k money. It’s not as tough as you think. In fact, it can be done in just two steps – taking no more than 30-45 minutes of your time.

If you’re like most folks, when you look at a 401k plan’s options you’re completely overwhelmed. Where to start? Of course, the starting point is to sign up to participate – begin sending a bit of your paycheck over to the 401k plan. A good place to start on that is at least enough to get your employer’s matching funds, however much that might be. In this article though, we’re looking at investing your 401k money. It’s not as tough as you think. In fact, it can be done in just two steps – taking no more than 30-45 minutes of your time.

Lots of us have a hobby – whether it’s collecting stamps, raising honeybees, restoring old Jeeps, or mounting a wild-cat – and sometimes these hobbies can produce income. If you have a hobby that makes money, you may need to claim this money as income, net of your expenses, on your tax return.

Lots of us have a hobby – whether it’s collecting stamps, raising honeybees, restoring old Jeeps, or mounting a wild-cat – and sometimes these hobbies can produce income. If you have a hobby that makes money, you may need to claim this money as income, net of your expenses, on your tax return.

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.