I often hear from people who, for whatever reason, decided to file for their Social Security retirement benefit immediately upon reaching 62 (or 66, or whatever age), and now they have found out that this wasn’t necessarily the best option for them to maximize their lifetime Social Security benefits.

There are several things that you can do about this – three that come to mind at the moment. Below we’ll work through each of these ways to fix a situation where you filed too soon.

Pay it back

If it’s been less than 12 months since you filed, it’s possible for you to withdraw your application for benefits and pay back all that you’ve received to date. Once you’ve done this, as far as Social Security is concerned, you never filed. All of your benefit options are intact, just as if you hadn’t filed in the first place.

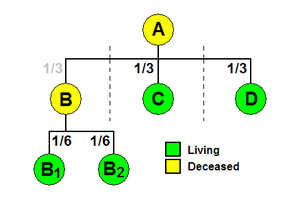

If your spouse or other beneficiaries began receiving benefits based on your record when you filed for your own benefit, those benefits will cease, and all benefits that your spouse or beneficiaries have received to date will also have to be paid back.

This can be quite costly to do, but the increased future benefits are likely worth the cost.

Work it off

If it’s been more than 12 months since you filed or if the cost to pay it all back is just too much to stomach, there’s another way to sort of re-set your options. This method isn’t as good as the payback option, but it’s the next best available to fix your problem if you are still working (or can get a job) and you’re younger than Full Retirement Age (FRA).

Here’s how it works: if you are under FRA and working while receiving Social Security benefits, for each two dollars above a certain limit ($15,120 in 2013 and adjusted each year) one dollar of benefits will be withheld. For example, if you are receiving $12,000 per year in Social Security benefits and you get a job that pays you $25,000 a year, $4,940 of your benefits will be withheld. Since you’re receiving $1,000 per month in benefits, this means that 5 months per year will be withheld.

Once you reach FRA (where the earnings limit no longer applies) if you have earned that extra amount for four years (thereby giving up 20 months’ worth of benefits) your benefit will be adjusted. The adjustment makes your benefit reduction appear as if you filed 20 months later than when you actually did. So if you originally filed at exactly age 62, your benefit would be reset at FRA as if you filed at age 63 and 8 months. This would have the effect of increasing your benefit by 9.44%.

If you earned enough in your job to eliminate all of your Social Security benefits between age 62 and 66, you would effectively re-set your benefit as if you had delayed filing until age 66.

During the year that you will reach FRA, the earnings limit is different, and it’s applied differently as well. You can earn as much as $40,080 for the year, and each three dollars above that limit will reduce your benefit by one dollar.

It’s important to note that these earnings must be active earnings, such as from a regular job or self-employment. Withdrawals from an IRA, while taxable, are not counted toward the earnings limit and can’t be used to reset your benefits.

Suspend

Although most of the time the concept of suspending your benefit is discussed as a part of the “file & suspend” tactic, where you file and then immediately suspend receiving benefits in one action, you are allowed to suspend your benefits at or after FRA regardless of when you originally filed. So, if you filed for your Social Security retirement benefit early and you decided that it was a mistake, when you reach FRA you have the option of suspending your benefit and allowing the delay credits to accrue on your record.

For example, if you filed at age 63 and collected benefits until you reached FRA at age 66, you could suspend your benefits at that point. If you were receiving a $1,000 benefit from filing at age 63, this was 80% of your PIA, which would have been $1,250. If you suspend at FRA and then re-file at age 70, then your delay credits would be 32% – which would bring your total benefit up to 112% of your PIA, for a new benefit of $1,400.

While your benefit is suspended your spouse and/or beneficiaries will continue to receive their benefits based on your record just the same as if you were actually collecting the benefits (subject to the family maximum). The delay credits, once earned, will not have an effect on those benefits that they’re receiving while you’re alive, but the delay credits will be applied to any survivor benefits that they receive after your passing.

The Combo

You could use the Suspend option in tandem with the Work it off strategy: by earning above the limit each year you’re improving the benefit that you’re eligible for at FRA – and then when you get to FRA you can suspend your benefits to further increase your benefit.

In addition to the above options, if none of them will fit your needs (such as if you don’t have another source of funds to get you by while you suspend and delay), if your spouse has not yet filed you can delay your spouse’s benefits as long as possible in order to maximize that benefit. Of course, this is to assume that your spouse hasn’t already filed too. There are several strategies that could help you to maximize benefits in that case, including filing a restricted application once he or she reaches FRA.

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.