American Gold Eagle (Photo credit: Wikipedia)

We had a great question come in by request this week that we address the question of whether folks should have gold in their portfolios.

Gold can be included under the umbrella of a larger asset class known as commodities. Think of commodities as items used to make or produce other items – such as gold is used to produce jewelry, circuitry and coinage, while timber is used to make lumber and paper, while coal is used to make electricity and disappoint not-so-good kids on Christmas morning (sorry, couldn’t resist).

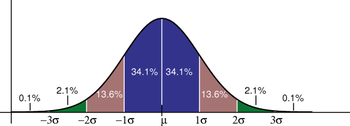

Getting back to gold, the reason an investor may want to consider it as part of their portfolio is because gold is correlated differently from the stock market. Simply put; its pricing moves differently relative to the stock market. This does not mean I’m recommending investors buy gold. Here’s why.

Imagine a lump of gold sitting on your kitchen table. What does it do? Nothing. It simply sits there. It produces no income, and according to a 2013 article in the Financial Analysts Journal, there was little evidence that gold was a hedge against inflation.

Even the great Oracle of Omaha, Warren Buffett has this to say about gold:

“What motivates most gold purchasers is their belief that the ranks of the fearful will grow. During the past decade that belief has proved correct. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis. As “bandwagon” investors join any party, they create their own truth – for a while.” http://www.berkshirehathaway.com/letters/2011ltr.pdf

My personal and professional opinion is that if an investor is bitten by the “gold bug”, consider putting your emotions aside and ask yourself why you want to invest in gold. Is it because everyone else is doing it, or is it because you know something the market doesn’t (likely rare)? I have joked with clients and students saying that if there’s an absolute “black swan” and the entire US and World economies collapse, what good is gold going to do us? We can’t eat it, can’t drink it, and it produces nothing in and of itself. Time to grow a vegetable garden as food will be a more valuable commodity at that point.

One area where gold may be a good investment is for numismatic purposes. Collecting various gold coins in various conditions and ages can be fun, rewarding and make an excellent hobby that can be passed on to heirs. Additionally, gold coins such as American Gold Eagles, South African Krugerrands, Canadian Maple Leafs and Chinese Pandas tend to hold their value more than the bullion will – simply because it has the numismatic value of collection, scarcity, and condition.

Finally, you may already “own” gold in your portfolio if you hold a broad based index such as a total stock market index fund or ETF (which our investment clients do). The reason I say you already “own” the gold is by owning broad index funds you’re already investing in companies that mine for and produce the precious metal. While you don’t technically own the asset; generally when the price of gold increases so does the stock of the companies that mine it.

There are even ETFs and index funds that hold commodities in general. While not specific to gold they hold gold, silver, timber and other commodities for additional asset allocation correlated differently to the market.Learn the latest silver prices forecast.

Other than starting a hobby or becoming a serious numismatist, there generally isn’t a need to own gold in order to achieve adequate diversification for potential long term portfolio success.

There’s nothing worse than feeling as if you have your Social Security filing strategy all lined out, when a rule like deemed filing rears its ugly head to throw your strategy off track.

There’s nothing worse than feeling as if you have your Social Security filing strategy all lined out, when a rule like deemed filing rears its ugly head to throw your strategy off track.

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.