Photo credit: jb

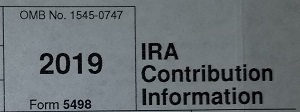

If you have money in an IRA and you’d like to do a tax free Roth conversion, you may be wondering just how to do it. There are actually several ways to do a tax free Roth conversion, and three very common options are listed below.

After-Tax IRA Contributions

If your traditional IRA is composed only of after-tax (non-deducted) contributions, you can convert those funds over to a Roth IRA without tax consequence. This is because the funds were taxed before you contributed them to the IRA, and so no tax is due when you convert the funds to a Roth IRA. This often is the case if you have no other traditional IRAs and you’ve made non-deductible contributions to the account (often from income limitations). You can convert these non-deductible contributions from the traditional IRA to a Roth IRA with no tax consequences. The only tax (if this is your only traditional IRA and it only contains non-deductible contributions) is if there is any growth on the contributed funds, such as interest earned or capital gains that have occurred.

The “gotcha” in this is that the IRA must be ONLY non-deducted, after-tax contributions. Plus this must be the only IRA that you have – see the article: Turns Out You CAN Be A Little Bit Pregnant for more details, including a way around the “Pregnant” Rule.

If you happen to have other IRAs or other, deducted contributions in the traditional IRA, it’s not the end of the world. You’ll just have more tax to pay on the Roth Conversion.

After-Tax Qualified Retirement Plan Contributions

If you happen to have after-tax contributions to a Qualified Retirement Plan (QRP) such as a 401k plan, these can be used for a tax free Roth Conversion if you’ve terminated employment or the retirement plan has terminated. You can do this without having to worry about the “Pregnant” rule I mentioned above. This is because QRP funds are treated differently, and as such you are allowed to move specific contribution money separate from other contribution money (e.g., pre-tax contributions separate from after-tax contributions).

Also, if you have money in a Roth 401k, it’s not actually considered a conversion but you can rollover your Roth 401k money into a Roth IRA with no tax consequences, as long as your plan allows. Generally this means you have either reached age 59½ (for some plans; many do not allow in-service distributions), or you must have left employment with that employer.

Zero Tax Bracket

If you have no or very low taxable income, that is, if you’re below the 10% tax bracket, any funds that you distribute from your traditional IRA up to the limit – which would be your AGI minus your exemptions and itemized or standard deductions and any tax credits – would be tax free. Granted, this is likely to be a somewhat small amount for most people in this situation, but for others, such as business owners or farmers with carried-over Net Operating Losses, it could be sizeable. See the linked article for more information on NOL carryovers and Roth IRA conversions.

Photo by Phillip

As a retiree, you may have a bit more difficulty determining if your withheld tax throughout the year is going to be enough. This is especially true in 2018, with the new tax tables and rules associated with the Tax Cuts and Jobs Act of 2017. For this reason, you may want to do a mid-year estimated payments checkup, to help ensure you’re having enough (but not too much) tax withheld.

As a retiree, you may have a bit more difficulty determining if your withheld tax throughout the year is going to be enough. This is especially true in 2018, with the new tax tables and rules associated with the Tax Cuts and Jobs Act of 2017. For this reason, you may want to do a mid-year estimated payments checkup, to help ensure you’re having enough (but not too much) tax withheld. Now that we have a few months’ worth of the new tax tables (from the Tax Cuts and Jobs Act of 2017) under our belts, it’s a good idea to do a withholding checkup against your paycheck. A withholding checkup is a common exercise that many people perform to make sure that they are having enough, but not too much, tax withheld throughout the year. You can do a withholding checkup at any point in the year (after at least one paycheck), so feel free to use this process later in the year as you see fit.

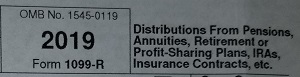

Now that we have a few months’ worth of the new tax tables (from the Tax Cuts and Jobs Act of 2017) under our belts, it’s a good idea to do a withholding checkup against your paycheck. A withholding checkup is a common exercise that many people perform to make sure that they are having enough, but not too much, tax withheld throughout the year. You can do a withholding checkup at any point in the year (after at least one paycheck), so feel free to use this process later in the year as you see fit. If you are retiring before the “normal” retirement age of 59½ or older, or if you find yourself in need of money, you may need to make an early withdrawal from your retirement plan. An early withdrawal from your retirement plan is not without consequences – there will be taxes for sure, and quite possibly (likely?) penalties (referred to as “additional tax on early withdrawals” below). For

If you are retiring before the “normal” retirement age of 59½ or older, or if you find yourself in need of money, you may need to make an early withdrawal from your retirement plan. An early withdrawal from your retirement plan is not without consequences – there will be taxes for sure, and quite possibly (likely?) penalties (referred to as “additional tax on early withdrawals” below). For  Rollover. A

Rollover. A  As reviewed in the article

As reviewed in the article  When a worker is receiving retirement benefits and/or members of his family are also receiving benefits based upon the retirement benefits, such as via spousal benefits, benefits for children, or other family members benefits, there is a maximum amount of benefit that can be distributed in total. (There is a separate maximum benefit computation for disability benefits, which we’ll cover in another article.)

When a worker is receiving retirement benefits and/or members of his family are also receiving benefits based upon the retirement benefits, such as via spousal benefits, benefits for children, or other family members benefits, there is a maximum amount of benefit that can be distributed in total. (There is a separate maximum benefit computation for disability benefits, which we’ll cover in another article.)

The Full Retirement Age, or FRA (gotta love Social Security for their acronyms!), is a key figure for the individual who is planning to receive Social Security retirement benefits. Back in the olden days, when Social Security was first dreamed up, Full Retirement Age was always age 65.

The Full Retirement Age, or FRA (gotta love Social Security for their acronyms!), is a key figure for the individual who is planning to receive Social Security retirement benefits. Back in the olden days, when Social Security was first dreamed up, Full Retirement Age was always age 65.

When Congress was debating the merits of the Tax Cuts and Jobs Act of 2017 (TCJA) late last year, one of the items that took a lot of focus was the change to the Standard Deduction. The Standard Deduction was increased to nearly double what it was in years’ past. The deduction went from $12,700 in 2017 for joint filers to $24,000; for singles, the increase went from $6,350 to $12,000. Single filers over age 65 get an extra $1,600 deduction; married filers get to increase their Standard Deduction by $1,300 each if over age 65*. A byproduct of this change is that QCD (

When Congress was debating the merits of the Tax Cuts and Jobs Act of 2017 (TCJA) late last year, one of the items that took a lot of focus was the change to the Standard Deduction. The Standard Deduction was increased to nearly double what it was in years’ past. The deduction went from $12,700 in 2017 for joint filers to $24,000; for singles, the increase went from $6,350 to $12,000. Single filers over age 65 get an extra $1,600 deduction; married filers get to increase their Standard Deduction by $1,300 each if over age 65*. A byproduct of this change is that QCD (

In 2018, folks who are reaching that magical age of 66, which is Full Retirement Age (or FRA, in SSA parlance), may have some decisions to make. This is especially true for married couples, or folks who were married before and are now divorced. The restricted application still applies if you were born before 1954.

In 2018, folks who are reaching that magical age of 66, which is Full Retirement Age (or FRA, in SSA parlance), may have some decisions to make. This is especially true for married couples, or folks who were married before and are now divorced. The restricted application still applies if you were born before 1954.

It is important to know and understand who can be claimed as a dependent, as well as who can generate a personal exemption for your taxes. It’s not as simple as you might think, especially in complex family situations, such as when a child lives separate from one of his parents, or when there are more than two generations living in the same home.

It is important to know and understand who can be claimed as a dependent, as well as who can generate a personal exemption for your taxes. It’s not as simple as you might think, especially in complex family situations, such as when a child lives separate from one of his parents, or when there are more than two generations living in the same home. Under the newly-passed Tax Cuts and Jobs Act of 2017 (TCJA), there has been a slight change for folks who have taken loans from their workplace retirement plan and subsequently left the job before paying the loan back. These 401k loan distributions (as they are known) are immediately due upon leaving the job, considered a distribution from the plan if unable or unwilling to pay it back. This results in a taxable distribution, plus a 10% penalty unless you’re over age 59½. (You could avoid the 10% penalty as early as age 55 if you’re leaving the employer.)

Under the newly-passed Tax Cuts and Jobs Act of 2017 (TCJA), there has been a slight change for folks who have taken loans from their workplace retirement plan and subsequently left the job before paying the loan back. These 401k loan distributions (as they are known) are immediately due upon leaving the job, considered a distribution from the plan if unable or unwilling to pay it back. This results in a taxable distribution, plus a 10% penalty unless you’re over age 59½. (You could avoid the 10% penalty as early as age 55 if you’re leaving the employer.) Retirement can be one of the most anticipated and exciting times in a person’s life. When the time comes to start this new chapter, it is important to consider all of the factors to make the transition as easy as possible. Diligent financial planning is one of the most important things that can make a senior’s retirement successful, and it is especially helpful to know that there are some states that have better financial environments than others. Whether retirees already live in one of these states, or are looking for a new place to reside, knowing expense expectations can help seniors make the right decision about their future.

Retirement can be one of the most anticipated and exciting times in a person’s life. When the time comes to start this new chapter, it is important to consider all of the factors to make the transition as easy as possible. Diligent financial planning is one of the most important things that can make a senior’s retirement successful, and it is especially helpful to know that there are some states that have better financial environments than others. Whether retirees already live in one of these states, or are looking for a new place to reside, knowing expense expectations can help seniors make the right decision about their future. One of the provisions in the Tax Cuts and Jobs Act of 2017 (TCJA) included the ability for an owner of a 529 education savings plan (such as Illinois’ Brightstart) to use the funds for K-12 private schooling just the same as for post high school expenses. This means that, at least at the federal level, owners of these plans will not pay tax on the growth of these funds if used for any private K-12 schooling. Previously this option was only available with a Coverdell savings plan, but TCJA extends this treatment to 529 plans.

One of the provisions in the Tax Cuts and Jobs Act of 2017 (TCJA) included the ability for an owner of a 529 education savings plan (such as Illinois’ Brightstart) to use the funds for K-12 private schooling just the same as for post high school expenses. This means that, at least at the federal level, owners of these plans will not pay tax on the growth of these funds if used for any private K-12 schooling. Previously this option was only available with a Coverdell savings plan, but TCJA extends this treatment to 529 plans. For years now, the

For years now, the

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.