What is the “fiscal cliff”? It’s the term being used by many to describe the unique combination of tax increases and spending cuts scheduled to go into effect on January 1, 2013. The ominous term reflects the belief by some that, taken together, higher taxes and decreased spending at the levels prescribed have the potential to derail the economy. Whether we do indeed step off the cliff at the end of the year, and what exactly that will mean for the economy, depends on several factors.

Will expiring tax breaks be extended?

With the “Bush tax cuts” (extended for an additional two years by legislation passed in 2010) set to sunset at the end of 2012, federal income tax rates will jump up in 2013. We’ll go from six federal tax brackets (10%, 15%, 25%, 28%, 33%, and 35%) to five (15%, 28%, 31%, 36%, and 39.6%). The maximum rate that applies to long-term capital gains will generally increase from 15% to 20%. And while the current lower long-term capital gain tax rates now apply to qualifying dividends, starting in 2013, dividends will once again be taxed as ordinary income.

Additionally, the temporary 2% reduction in the Social Security portion of the Federal Insurance Contributions Act (FICA) payroll tax, in place for the last two years, also expires at the end of 2012. And, lower alternative minimum tax (AMT) exemption amounts (the AMT-related provisions actually expired at the end of 2011) mean that there will be a dramatic increase in the number of individuals subject to AMT when they file their 2012 federal income tax returns in 2013.

Other breaks go away in 2013 as well.

- Estate and gift tax provisions will change significantly (reverting to 2001 rules). For example, the amount that can generally be excluded from estate and gift tax drops from $5.12 million in 2012 to $1 million in 2013, and the top tax rate increases from 35% to 55%.

- Itemized deductions and dependency exemptions will once again be phased out for individuals with high adjusted gross incomes (AGIs).

- The earned income tax credit, the child tax credit, and the American Opportunity (Hope) tax credit all revert to old, lower limits and less generous rules.

- Individuals will no longer be able to deduct student loan interest after the first 60 months of repayment.

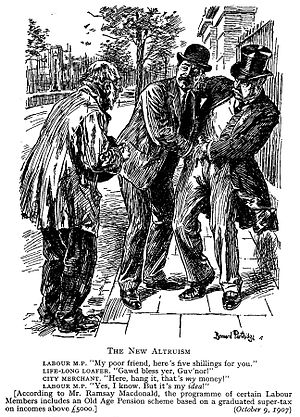

There continues to be discussion about extending expiring provisions. The impasse, however, centers on whether tax breaks get extended for all, or only for individuals earning $200,000 or less (households earning $250,000 or less). Many expect there to be little chance of resolution until after the November election.

Will new taxes take effect in 2013?

Beginning in 2013, the hospital insurance (HI) portion of the payroll tax–commonly referred to as the Medicare portion–increases by 0.9% for individuals with wages exceeding $200,000 ($250,000 for married couples filing a joint federal income tax return, and $125,000 for married individuals filing separately).

Also beginning in 2013, a new 3.8% Medicare contribution tax is imposed on the unearned income of high-income individuals. This tax applies to some or all of the net investment income of individuals with modified adjusted gross income that exceeds $200,000 ($250,000 for married couples filing a joint federal income tax return, and $125,000 for married individuals filing separately).

Both of these new taxes were created by the health-care reform legislation passed in 2010–recently upheld as constitutional by the U.S. Supreme Court–and it would seem unlikely that anything will prevent them from taking effect.

Will mandatory spending cuts be implemented?

The failure of the deficit reduction supercommittee to reach agreement back in November 2011 automatically triggered $1.2 trillion in broad-based spending cuts over a multiyear period beginning in 2013 (the formal term for this is “automatic sequestration”). The cuts are to be split evenly between defense spending and nondefense spending. Although Social Security, Medicaid, and Medicare benefits are exempt, and cuts to Medicare provider payments cannot be more than 2%, most discretionary programs including education, transportation, and energy programs will be subject to the automatic cuts.

New legislation is required to avoid the automatic cuts. But while it’s difficult to find anyone who believes the across-the-board cuts are a good idea, there’s no consensus on how to prevent them. Like the expiring tax breaks, the direction the dialogue takes will likely depend on the results of the November election.

What’s the worst-case scenario?

Many fear that the combination of tax increases and spending cuts will have severe negative economic consequences. According to a report issued by the nonpartisan Congressional Budget Office (Economic Effects of Reducing the Fiscal Restraint That Is Scheduled to Occur in 2013, May 2012), taken as a whole, the tax increases and spending reductions will reduce the federal budget deficit by 5.1% of gross domestic product (GDP) between calendar years 2012 and 2013. The Congressional Budget Office projects that under these fiscal conditions, the economy would contract during the first half of 2013 (i.e., we would likely experience a recession).

It’s impossible to predict exactly how all of this will play out. One thing is for sure, though: the “fiscal cliff” figures to feature prominently in the national dialogue between now and November.

The foregoing post was brought to you by Broadridge/Forefield.

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.