Hey, soon-to-be-graduates: as you begin to make your way out into the world of full-time employment, you’ll soon be faced with many, many “grown up” ways to spend the money you’ll be earning. You’ll of course have rent, insurance, food and clothing, maybe a car payment, and you’ll want to use some of that new-found money to blow off steam, however you choose to do that – maybe fulfilling a lifetime dream of getting “beaked” by Fredbird, for example.

Hey, soon-to-be-graduates: as you begin to make your way out into the world of full-time employment, you’ll soon be faced with many, many “grown up” ways to spend the money you’ll be earning. You’ll of course have rent, insurance, food and clothing, maybe a car payment, and you’ll want to use some of that new-found money to blow off steam, however you choose to do that – maybe fulfilling a lifetime dream of getting “beaked” by Fredbird, for example.

If you’re on top of your game, you’ll may also be thinking about saving some of your earnings. Here, you’ll have a bundle of options to choose from – regular “bank” savings accounts, 401(k) plan (or something similar) from your employer, and IRA accounts, both the traditional deductible kind and the Roth kind (hint: the Roth kind is what I want you to pay particular attention to).

Side note: even if you’re not actively thinking of saving money at this stage, chances are you’ll begin thinking about savings activities soon, and definitely at some point in the next 40 years, since saving toward retirement is pretty much YOUR own responsibility. In the next few years you’re going to be thinking about buying a home, possibly marriage and a family, and other longer-term kinds of things that require significant amounts of money. If you start on the savings process and get it into your mindset early, you’ll be miles ahead of your peers, and you’ll probably have built up a significant savings by the time you’re ready for these goals.

As you think about savings activities and all of these types of savings accounts, it’s important to gather knowledge about the features and benefits of the various accounts and how this will play into deciding what’s the best place to put your savings.

Emergency Savings

Briefly reviewing the accounts I listed, you might start with a regular savings account at a bank. You probably have a checking account of some type, so you can open a savings account at that same institution as well. This account could be used for developing an emergency fund. This is so that, when you need new tires for your car, or you need to put down a deposit on a new apartment, you’ll be able to use these funds for that purpose, rather than using a credit card or otherwise going into debt.

Another very good reason to have an emergency fund is to help you get by if you should happen to find yourself unemployed. I’d suggest putting enough into your emergency fund to cover your monthly expenses for at least 3 months. If you’re conservative you might put as much as a year’s worth of expenses into the account – in either case, maintain that level over time, in tandem with your other savings activities. This saving can be done automatically, via automatic transfer from your checking account, for example. By automatically saving, you won’t have to *decide* if you’re going to save – it will happen without you having to make a decision.

There are no significant tax benefits with a savings account, so your saving activities should include some of the other plans that you have available.

Retirement Saving – 401(k)

Next, once you’ve begun your emergency fund, you should begin thinking about longer-term saving. If you have a 401(k) plan available via your employer (or a comparable plan, such as a 403(b) or a 457 plan), you should consider taking advantage of this. This is especially true if your employer offers a “matching” program – where the employer will put money into the account as you put money into it. Often this matching is done either on a dollar-for-dollar basis up to a certain percent, or on a percentage of contributions.

For example, the company might match your contributions dollar-for-dollar up to 3% of your salary – meaning that if you put 1% of your salary into the account, the company will also put 1% into the account on your behalf. You can put as much as 3% (for this example) into the account and the company will match it. You will be eligible to put more in the account than what the company matches, but at this stage you might want to limit it to matched amount (more on this in a bit).

The other example that I gave is where the company matches on a percentage basis – this might be expressed as 50% matching up to a 6% employee contribution. If this was the case, when you put in 1%, the company would match your contribution with a .5% contribution. If you put in 4%, the company would match it with 2%, and so on, up to a 3% match for your 6% contribution.

The benefit of this kind of account is that, as you contribute money to the account, it’s taken out of your paycheck PRIOR to income tax, which will then reduce your taxable income for the year. The money in the account (including the employer matches, which you’re also not taxed on in the current year) is then invested, hopefully growing over time. The growth in the account is likewise untaxed, until you take the money out of the account. At that time, you’ll pay ordinary income tax on the money that you take out of the account.

The downside to this kind of account is that, generally, the money that you put into the account is more or less locked up until you reach age 59½. While there are ways to get at the money before that point, the real purpose of this account is to save toward retirement, so any money you put into your 401(k) plan should be considered very long-range savings.

Retirement – Traditional IRA

If you don’t happen to have a 401(k) plan available at your employer, another option to consider for longer-range saving is the Traditional IRA. The way this works is that you open the IRA account and put up to $5,000 (and when you are over age 50, you can put an additional $1,000) into the account each year. Then, when you file your income tax return for the year, you are eligible to deduct that contribution amount from your income (subject to limits).

After that, the Traditional IRA acts pretty much like the 401(k) plan described before: your savings (hopefully) grows via investments and no tax is owed until you take the money out of the account – usually at age 59½ or later. At that time you’ll pay ordinary income tax on the money as you withdraw it. As with the 401(k) you *could* take the money out earlier, but generally there would be penalties for doing so. As such, the Traditional IRA should be for your longer-term savings.

Retirement and other goals – Roth IRA

FINALLY – we’ve gotten to the account that I brought you here to talk about: the Roth IRA.

A Roth IRA is a little bit like the savings account, in that it doesn’t present any tax savings for you as you put money into it (like the Traditional IRA or the 401(k) plan does). However, the real tax benefit comes as your account grows over time – when you take the money out after age 59½, there is no ordinary income tax owed on any of the money that you withdraw!

This is a big deal. You can put in as much as $5,000 per year (same as the Traditional IRA), and as that money grows over time, you won’t have to pay tax on it if you leave it in the account until age 59½. If you started saving $5,000 per year in a Roth account at age 22 and continued this until you were 42, I’ve illustrated how this could eventually become $33 million over time.

Possibly even a bigger deal is that you can use the Roth IRA as a sort of emergency fund, in addition to a retirement fund. The money that you’ve contributed to the Roth IRA over time can be withdrawn at any time for any purpose, without tax or penalty. The investment growth is restricted (like the other retirement accounts mentioned above, to age 59½ or older), but the money you contribute is unrestricted! This could give you that extra amount that you need for a down-payment on a home, for example.

It’s best to be very judicious in your use of this privilege, since the account is primarily for retirement – but it’s nice to know that you have this option available.

Conclusion

Let’s say that you have started a new job making $30,000 a year. After taxes are taken out, you have something on the order of $1,800 left each month. Taking care of rent, insurance, car payment, and all the other things you have to pay (don’t forget the “beaking”!), leaves you with $200 a month for saving.

Let’s say you earmark $50 for your emergency savings. Then, your employer provides a 3% matching plan for your 401(k), which amounts to $75 per month. Keeping things simple, let’s say that this leaves you with $75 for other savings activities. A Roth IRA is an excellent place to put this additional money.

The reason that a Roth IRA is the preferred place to put your excess savings money is because of the tax rate that you’re in at the present. The savings in tax would be something on the order of $11.25 if you put this additional $75 into a Traditional IRA or a 401(k) plan, and then you’d have your money locked up until retirement. Since you’re already (rightly) taking advantage of the 401(k) plan (and doubling your money via the employer match), using the Roth IRA provides you with an additional way to save with a diversified tax treatment.

All in all, the Roth IRA presents you with a very cost-effective way to save money over time, especially when you’re at the lower end of the tax brackets.

If you’re needing a few more reasons to go with the Roth IRA, try this: if you’re going to grad school, your contributions in your Roth IRA account could be used to help pay for school, but at the same time – retirement accounts in general are not included as sources when calculating financial aid. Plus, as you make contributions to a Roth IRA (also to other retirement accounts), depending on your income level you may be eligible for the Saver’s Credit. This is up to a 50% tax credit for your contributions to a retirement plan, including the Roth IRA.

Full Disclosure: That’s my daughter Emma being “beaked” by Fredbird. She’s a soon-to-be graduate of Western Illinois University, Class of ’12, and proud owner of a Roth IRA.

Sterling Raskie, MSFS, CFP®, ChFC®

Sterling Raskie, MSFS, CFP®, ChFC® The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on

The latest in our Owner’s Manual series, A 401(k) Owner’s Manual, was published in January 2020 and is available on  A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on

A Medicare Owner’s Manual, is updated with 2020 facts and figures. This manual is available on  Social Security for the Suddenly Single can be found on Amazon at

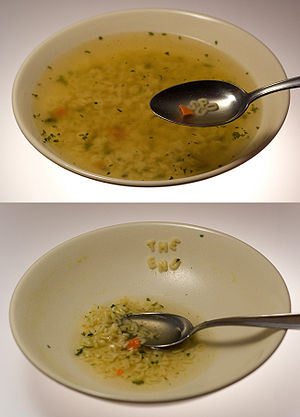

Social Security for the Suddenly Single can be found on Amazon at  Sterling’s first book, Lose Weight Save Money, can be

Sterling’s first book, Lose Weight Save Money, can be  An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the

An IRA Owner’s Manual, 2nd Edition is available for purchase on Amazon. Click the link to choose the  Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the

Jim’s book – A Social Security Owner’s Manual, is now available on Amazon. Click this link for the  And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.

And if you’ve come here to learn about queuing waterfowl, I apologize for the confusion. You may want to discuss your question with Lester, my loyal watchduck and self-proclaimed “advisor’s advisor”.